4 Strategies For Turning Your Savings Into Your First Million

It might not be what it used to be, but saving a million dollars still carries an air of accomplishment. For many in the Two Comma Club, attaining their goal was the result of some discipline, wise strategy, and an understanding of the forces that grow money. Here are some strategies to help you get to a million:

1. Start early (and if you can’t start early, start now)

Joining the Two Comma Club means understanding how powerful time is. While starting late doesn’t make your goal impossible, starting earlier can make attaining a million dollars easier.

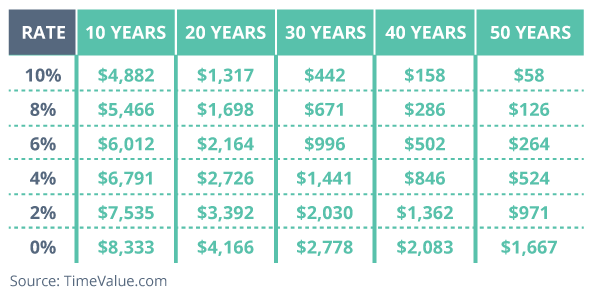

As the number of years you have to save dwindles, the amount you’ll need to save and the work your savings must do changes dramatically.

This chart shows a number of scenarios under which someone could potentially reach a million dollars. The path certainly appears easier for an 18 year old – but then again, not many 18 year olds have retirement on their mind.

2. Don’t Miss A 401(k) Opportunity

If your employer offers a 401(k) plan, you’ve got an opportunity to hitch a ride on a savings vehicle like no other. While you might be aware of some of the benefits of a 401(k) plan, some advantages aren’t as widely known.

- 401(k) contributions are taken out of your income pre-tax, so you can save without having to pay taxes on that money up front

- Participation is allowed at older ages, so you can continue to save in your plan and defer paying income tax on your savings – if permissible by your employer – until you leave your job. This differs from a savings tool like an IRA, which doesn’t allow a tax deduction for your traditional IRA contributions after you turn 70 ½.

- Employers often match contributions up to a certain percent. A recent study showed that 1 in 4 American workers are leaving $24 billion[1] in matching contributions from their employers. You’ll have to be smarter than that to make the Two Comma Club.

- The plan, the investments inside it, and all the records for it are all maintained by your employer, which makes this a convenient way to save and stay on top of recording your savings.

3. Pay Yourself First

Savers sometimes figure they’ll sock away money – after everything gets paid off. Paying yourself first is a mindset where you make savings a critical, top-line priority – even before paying bills. It’s a hard-to-master discipline with powerful ramifications, and it helps you accept the priority of savings in your life.

4. Understand Risk – and Harness It

It’s extremely unlikely you can store your savings in a coffee can and get into the Two Comma Club. Even if you started saving at age 18, you’ll still need to harness other forces to help your savings grow.

Our current economic climate’s interest rates are so low, they barely fit onto the chart provided above. If you’re planning on reaching your goal, you may have to seek other investment opportunities.

Investing in the stock market – even in the form of a mutual fund or an exchange-traded fund – is a fine example of taking on risk in pursuit of growing wealth. While there are many factors to consider before diving in, keep in mind that long-term data for stock market returns are around 7%[2].

If you’re motivated to reach a million dollars, but still have questions on how to get to your goal, give us a call at Annex Wealth Management. We’re overwhelmed by the responses we’re getting to our financial planning experience. Experience it for yourself, and we can give you independent advice that helps you establish a plan that fits your goal.

[1] https://financialengines.com/education-center/employer_match_results/

[2] http://www.thesimpledollar.com/where-does-7-come-from-when-it-comes-to-long-term-stock-returns/

Advisory Services offered through Annex Wealth Management®, LLC.

Securities offered through H. Beck, Inc Member FINRA & SIPC.

Annex Wealth Management®, LLC and H. Beck, Inc are separate and unrelated companies.

This site has been published for residents of: AZ, CA, CO, FL, IL, MN, NC, SC, TN, TX & WI ONLY. By entering you certify you are a resident of one of those states. All information herein has been prepared solely for information purposes, and it is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security.