People are sometimes surprised to hear that I majored in philosophy when I was in school and only got a minor in economics. How does one parlay a philosophy degree into a career dedicated to

People are sometimes surprised to hear that I majored in philosophy when I was in school and only got a minor in economics. How does one parlay a philosophy degree into a career dedicated to

retirement plans, you ask? It’s a long story and the honest answer is that it was total dumb luck. But let me put a more nuanced spin on it for you, and relate it to recent financial market instability.

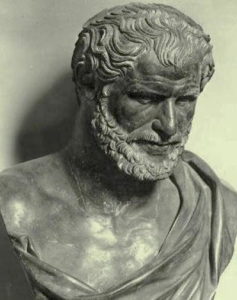

One of my favorite philosophers was Heraclitus. This guy thought that it was pretty much impossible to be certain of anything. He based this theory on his observation that everything is in a constant state of change and as such, that of which you believe yourself to be certain has changed since you made your initial assessment and therefore, you can no longer be certain of that assessment. One of his most famous quotes is, “Nothing endures but change.”

So what in the world does this have to do with investment markets? If you don’t already have an inkling of where I’m going with this, then I’m guessing that you haven’t been paying a whole lot of attention to the stock market in 2016. Let’s just say that every day brings a new adventure!

Whenever I talk about the importance of asset allocation with our clients I remind them that we all pretty much react the same way when the stock market goes up: “Yay!” When the going gets rough, however, we have an innate tendency to question our strategy. It’s just the way many of us are wired. I’ve never met a person who likes to see his account balance go down regardless of how many years he has to go before retirement.

A common saying in the investment world is one we’ve all heard, “Buy low. Sell high.” Think about that for a second. It makes total sense. In fact, it is juvenile in its simplicity. So why doesn’t

everybody heed this patently obvious advice? For one thing, nobody knows when the market is at a peak or if it is in the depths of a trough. In my opinion, the more compelling reason this prescription often fails is that while it is an extremely simple concept to understand, it is an extraordinarily difficult one to execute.

everybody heed this patently obvious advice? For one thing, nobody knows when the market is at a peak or if it is in the depths of a trough. In my opinion, the more compelling reason this prescription often fails is that while it is an extremely simple concept to understand, it is an extraordinarily difficult one to execute.

Again, think about it for a second. “Buy low. Sell high.” Now think about it for a few more seconds. Ok. So, why does this frequently break down in practice?

Let’s take the “Buy low” side of the equation first. Most people would probably agree that “low” refers to an investment whose price has gone down. In other words, it has lost value. Well, who wants to buy something that is less valuable than it was before?

Now let’s look at the “Sell high” side of the equation. Suppose you bought a stock worth $10 a few years ago and it is now worth $50. Last time I checked, 50 is higher than 10. Why would you want to get rid something that just went up in value five-fold?

You’ve got to remember that investments aren’t like cars, cell phones, clothes or any number of other things that we spend money on every day. The value of an investment is in a constant state of change. Theoretically, the reason you’d sell something that went in up value from $10 to $50 is quite simple. Doing so would mean that you walk away with a $40 profit. Conversely, the reason you’d buy something that went from $50 down to $10 in price is there’s a real possibility that thing may go back up in price at some point in the future.

Enter: greed. “I know I already made $40 but what if it goes up more? I’ll miss out on that additional gain!” Another problem is fear. “I know this thing is selling at a big discount but what if it goes down even further? I’ll lose money.” Yeah, well…that’s why they’re called Risk Assets.

So what should you do? There’s no specific prescription but I always suggest trying to be honest with yourself about how you’ll react when the market goes down because that’s when many of us get ourselves into trouble. It’s certainly not a bad idea to align yourself with an advisory team that can ask the kind of questions that help you arrive at an informed decision.

So there you have it. That’s probably not the kind of sophistication you were expecting from a guy who spent four years of his life studying philosophy and economics. What can I say? I’m a cheesehead. We speak plainly in these parts. Besides, if unintelligible mumbo jumbo is your game, there’s no shortage of financial big shot wannabes who are more than willing to wow you with their very impressive (and equally dumbfounding) complicated jargon.