Week In Review

Annex Wealth Management’s Dave Spano and Brian Jacobsen discuss the factors that led to Monday’s market volatility, and what we can expect going forward.

In Case You Missed It

On Monday, we sent the following to clients letting them know where we were and where we believed we’re headed. If you aren’t getting clarity from your adviser when financial times are trying, let’s talk about what’s important to you and how we can help you reach your goals for lifestyle, growth and legacy.

August 5, 2024

Observations on the markets, rates, and the economy

Your Annex team has been hard at work monitoring recent market volatility. Please feel free to read the enclosed letter written by Dr. Brian Jacobsen and the Annex team, and listen to Dr. Jacobsen and Annex CEO Dave Spano review where we are and where we believe we’re headed.

In the whirlwind of today’s financial markets, one thing is crystal clear: markets are subject to mood swings. They can move faster and more in any given direction than dictated by the fundamentals of the economy and the businesses you invest in. Yet, amidst this chaos, one principle holds firm: true investing is about weathering these storms, not chasing fleeting trends – an investment horizon should be measured in years, not days.

As the market navigates its latest turbulence, focusing on long-term fundamentals and strategic patience remains the key to turning today’s turmoil into tomorrow’s opportunity. Amidst the storm of uncertainty, one truth remains: the real challenge lies not in predicting the next market move, but in managing emotions and behaviors. Here’s how we’re steering through the choppy waters and what it means for your portfolio and financial plan.

What has markets extremely moody lately? Markets are reacting negatively to a few recent developments:

- Ripple-effects from the Bank of Japan’s surprise rate hike

- Possible war in the Middle East

- The shake-up in the U.S. presidential race

- Some big tech stock earnings that were positive, but slightly disappointing

- Labor market strength that has weakened and fears that the Fed may be behind the curve

Japan’s Ripples

On July 31, the Bank of Japan delivered a surprise rate hike. Just like Federal Reserve moves can affect markets, so can moves by foreign central banks. Japan has been a source of cheap financing for many leveraged traders where they would borrow in Japan and then invest in riskier assets like tech stocks. So, when the Bank of Japan hiked rates, it caught a lot of those investors off-guard. Their unwinding of their trades has caused a lot of what we would call “technical selling.” It is selling that is rapid, but not really based on fundamentals. Those types of market moves can be abrupt, large, but ultimately temporary. This type of selling can create buying opportunities, but the buying needs to be focused on knowing what you own, why you own it, and how much you’re paying for it.

War Risks

War is clearly a major geo-political issue, but markets have eventually recovered to hit new highs after past conflicts. Having a financial plan and a portfolio aligned with that plan can help you be patient as things may or may not unfold.

U.S. Politics

The U.S. presidential election has been host to more turmoil than ever. One candidate was nearly assassinated. Another candidate dropped out. The odds of who will win have gone from a near lock to more of a coin-flip. This is bound to cause market reactions. The broad market tends to go up regardless of who sits in the Oval Office, but there are industries and areas that may do better or worse during that four-year stint. We believe in focusing more on policies than politics to help inform which industries and areas of the market are most attractive.

Tech’s High Hopes

We are also in the midst of “earnings season” where many companies are reporting their quarterly financial results. The market may have gotten overly enthusiastic about when the payoff from the artificial intelligence craze would materialize. Markets may have also underappreciated how much it costs companies to build and run these systems. However, we don’t believe a broad-based sell-off in the markets is warranted.

Economic Weakness

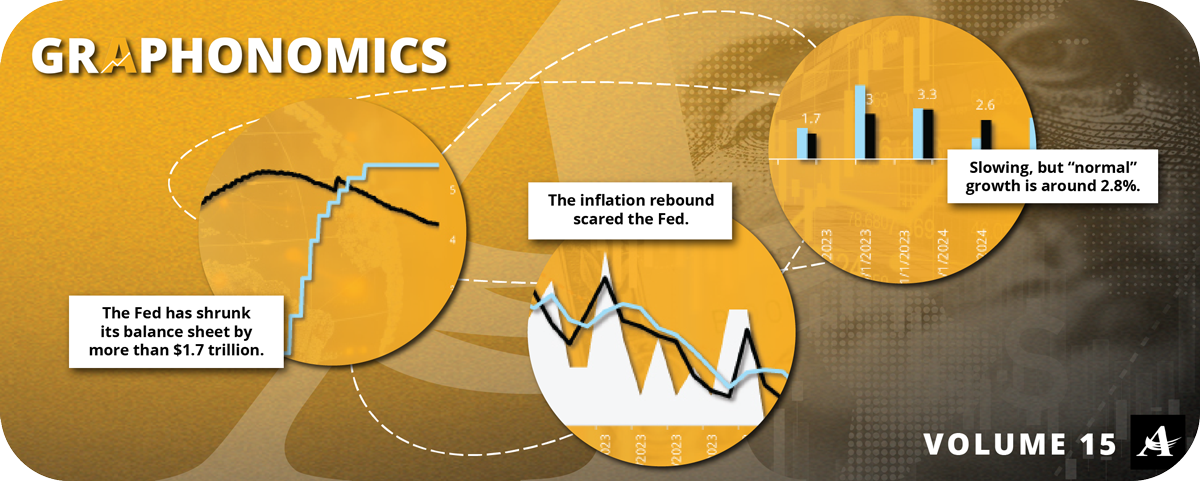

The final straw may have been the succession of weak economic data releases over the last week. Over the years we have been critical of the Federal Reserve for being too slow to react to rising inflation. They were then too slow to react to signs of economic softening. The latest jobs report number was disappointing, but it still showed positive job gains and an unemployment rate that is low by historical standards. Markets are forward-looking, so the fear is that the economy goes from great, to good, and then to a recession. Many companies you invest in still have solid fundamentals and have right-sized their operations and financing for a slowdown. It is important to remember that many businesses have spent the last year to year-and-and-half bracing for a recession that has yet to happen.

The Fed To The Rescue?

The Federal Reserve is likely to respond to the economic and market data by delivering a rate cut at its September meeting. It is possible that it could make an “inter-meeting” cut, but that has historically been used only for emergencies. An unemployment rate of 4.3% does not really look like an emergency.

How Annex Is Navigating These Markets

We take a top-down and a bottom-up approach to managing portfolios. That means being aware of what is going on with the broader economy and paying attention to the individual investment opportunities and risks that are out there. Our differentiated view on the economy and our attention to the details of individual opportunities led us to make a few notable moves in the run-up to these market moves. First, we had a focus on quality, meaning that we favored companies that have lower leverage and higher profit margin resilience than their peers. Second, we also recognized that the Fed was eventually going to need to cut as inflation and growth were both slowing. That meant adding some longer-term bonds to portfolios, anticipating that unlike during 2022 and 2023, bonds could once again rally if equities sold off.

Because the equity market drawdown might not be over, we are taking this opportunity to make further adjustments to portfolios. That means pivoting more towards value and lightening up on longer-term bonds that have rallied. Market corrections are rarely events that happen all at once. They are often a process that plays out over the course of weeks or months.

Focus On What You Can Control

We focus on diversification to improve the probability of hitting financial goals. Broad market sell-offs are the exception and not the rule, so it can appear as though diversification is not doing its job. But diversification can help capture the upswings in markets, which happen much more frequently than the downswings. Trying to time a sell also requires the tricky task of trying to time when to get back into the market. That is why diversification, patience, and a financial plan all have to work together.

In the midst of market turbulence driven by a mix of geopolitical uncertainties, economic shifts, and evolving political landscapes, it’s clear that staying the course with a well-thought-out strategy is more crucial than ever. Markets may be jittery, but history shows that patience and a focus on long-term fundamentals often prevail. Blind buying and forced selling by traders both can provide opportunities for long-term investors. We remain focused on knowing what you own, why you own it, and how much you are paying for it. We remain confident that your portfolio is aligned with your plan and we will continue to adapt that portfolio to changing conditions. By remaining diversified and adhering to a solid financial plan, you position yourself to weather the storm and capitalize on future opportunities. Remember, market swings are part of the journey, but your strategy should be built to navigate through them with confidence and resilience.

Ask Annex

Automatically Investing | Brokerage Accounts

Register Today!

Annex + WTMJ Webinars

In this two-part series, presenters from WTMJ and Annex Wealth Management will take a look at how the sunset of the Tax Cut and Jobs Act might affect the markets & economy.

August 15 – Tax Cuts Scheduled To End In 2025: What It Means To Investors

REGISTER →

August 22 – Tax Cuts Scheduled To End In 2025: What It Means To Your Plan

REGISTER →

Get Started

START →

Events

EXPLORE →