1. Will The Fed Reverse Course & Lower Rates In 2024? 2. Join Us! Moving In Retirement 3. Summer Internship Opportunities 4. How Do You Spend Your Holiday Calories? 5. 10 401(k) Things To Know 6. Get Your Tax-Smart Strategy Review Today! 7. Ask Annex: Quant Funds | Saving For Retirement | Holding Cash In Your Portfolio

1 | Week In Review

Annex strongly believes in frequent and meaningful communication.

Each Friday after market close, our experts record the “Week In Review”- exclusive insights to help you stay on top of the latest financial news.

Will The Fed Reverse Course & Lower Rates In 2024?

We’ve had decent economic growth numbers, inflation appears to be falling, and the fed is in a pause period. Looking ahead to 2024 – will the fed reverse course? Annex Wealth Management’s Dave Spano and Brian Jacobsen discuss.

BACK TO TOP ↑

2 | Register Now!

Annex Wealth Management Elm Grove Headquarters | 12700 W Bluemound Rd. Elm Grove, WI 53122

Join us for a lively, interactive workshop where we will be discussing moving in retirement.

Many are considering moving before or in retirement. As you make your decision, we’ll give you several key points to consider before you make your move – and why you should know the difference between residence and domicile.

Tuesday, December 5, 2023

6:00 PM – 7:30 PM CT

REGISTER →

BACK TO TOP ↑

3 | Did You Know?

Did you know Annex offers a summer internship program for college students between their Junior and Senior years to join us for the summer! We have five different internship opportunities available to share with college students you may know!

Join Our Growing Team in Our Spectacular New Brookfield Location In 2024!

Are you eager to kickstart your career in the dynamic world of finance and wealth management? Annex Wealth Management is excited to offer SUMMER internship opportunities across various departments, giving you the chance to gain valuable hands-on experience, learn from industry experts, and contribute to our innovative and client-focused approach. Join our team and embark on a journey of growth, learning, and professional development.

Annex Wealth Management is an elite, privately held, full-service advisory and wealth management firm acting as a fiduciary for individuals, families, and businesses. Our team approach means our clients consistently interact with a group of experienced professionals boasting key credentials, certifications, and achievements in investment, tax, insurance, estate planning, and more.

Communication and Education are key to Annex Wealth Management’s growth. Check us out on YouTube, “Money Talk” on WTMJ; “The Investment Show” on WISN; and “The Annex Wealth Management Show” on WHBY and WFSX.

We’re looking for college students between their Junior and Senior years to join us for the summer! We have 5 different internship opportunities available:

Investment Team Intern:

- Work alongside research analysts and traders to conduct investment research and enhance the investment team’s internal tools.

- Assist in tasks related to portfolio management and asset allocation.

- Learn from experienced investment professionals about the nuances of the financial markets.

Financial Planning Intern:

- Collaborate with CFP® professionals to create personalized financial plans for clients

- Get exposure to advanced planning tasks such as distribution planning, tax planning, social security optimization, and more!

- Shadow client and prospective client meetings to experience the delivery of financial planning to real life humans

Data Analytics Intern:

- Collaborate with our data team to collect, clean, and analyze financial data.

- Assist in identifying trends, patterns, and insights from the data.

- Contribute to the development of data-driven strategies for investment decisions and client recommendations.

Compliance Intern:

- Collaborate with our compliance professionals to ensure adherence to regulatory standards and internal policies.

- Assist in conducting compliance audits and reviews to identify potential areas of improvement.

- Learn about compliance requirements in the financial industry and contribute to maintaining a compliant environment.

Client Services Intern:

- Interact directly with clients and assist in addressing their inquiries and concerns.

- Prepare, send, track and record client documents and paperwork.

- Learn how to provide exceptional client service in a wealth management context.

What We Are Looking For

- Current college students between their Junior & Senior years enrolled in a relevant bachelor’s degree program

- Strong interest in finance, investments, & wealth management.

- Excellent communication skills & ability to work effectively in a team.

- Analytical mindset and attention to detail.

- Proficiency in Microsoft Office suite & willingness to learn new tools.

What You Can Expect

- Mentorship from experienced professionals in the finance industry with weekly leadership lunches.

- Exposure to real-world financial strategies and client interactions.

- Networking and volunteering opportunities with colleagues and industry experts.

- Possibility of future employment opportunities based on performance.

BACK TO TOP ↑

4 | Poll

The holidays are here bringing once-a-year favorites to the stores, nothing short of being spotlighted in the middle of the aisles as you’re trying to get your typical grocery staples… enticing you. Gathering with family and friends and an increase in holiday parties can invite indulgences and extra helpings on your plate & in your glass. But do the calories really count during the holidays?

BACK TO TOP ↑

5 | MoneyDo

10 Things You Must Know About Your 401(k)

Did you know retirement plans have been around for 40 years and counting? Financial security during retirement doesn’t just happen. It takes planning & commitment on your part. Read on below to discover the 10 things you MUST know about your 401(k).

This Week’s MoneyDo: Review the 10 Things You MUST Know About Your 401(k).

1. You receive a tax break for contributing to a 401(k).

a. What you put in comes off your taxable income in a pretax scenario.

2. There are contribution limits for 401(k)’s:

a. $22,500 + $7,500 catch-up (50 yrs. or older 2023)

b. $23,000 + $7,500 catch up (50 yrs. or older 2024)

3. You may be automatically enrolled depending on your employer.

4. There are fees associated with a 401(k)- They’re not free

a. Understand how fees work by reading the 2 fee disclosures available to you:

i. 408(b)(2) employer’s disclosure

ii. 404(a)(5) participant’s disclosure

5. You may choose from a selection of funds in your 401(k).

6. Your employer might let you choose individual stocks in your 401k plan.

7. You may have a Roth 401(k) option.

8. You can roll over a 401(k) account.

9. Eventually you must withdraw money from the 401(k).

10. You can borrow from your 401(k)… sometimes.

If you have questions determining how the above may impact you & your retirement plan, find an advisor you can trust – preferably one who’s a fee-only fiduciary all the time – who can help you navigate any 401(k)’s you may have.

Get A Clear Picture Of Taxes After Retirement.

BACK TO TOP ↑

6 | Talk To Us

Get Your Tax-Smart Strategy Review Today!

Get a real assessment of your current tax strategy, including areas you might want to consider. Let our planning team create an Annex Wealth Management Tax-Smart Strategy Review for you!

Build A Tax-Smart Legacy With Our Team.

BACK TO TOP ↑

7 | Ask Annex

CLICK HERE TO ASK US A QUESTION →

BACK TO TOP ↑

Annex Exclusive

Tax Planning In Uncertain Times

Get the Annex Wealth Management Year-End Tax Planning Guide. It will help you decide if you should update, eliminate, or calibrate your 2023 Tax Plan.

Get Your Tax Planning Guide Here! →

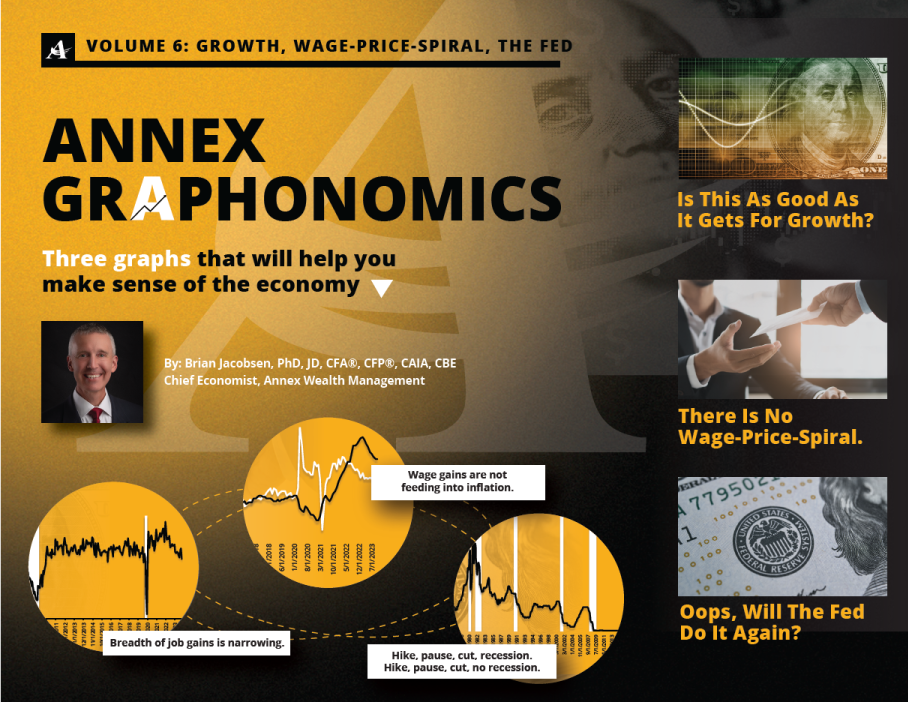

Graphonomics

Graphonomics Volume 6 Available Now!

Events & Webinars

Annex Wealth Management Elm Grove Office | 12700 W Bluemound Rd, Elm Grove, WI

Many are considering moving before or in retirement. As you make your decision, we’ll give you several key points to consider before you make your move – and why you should know the difference between residence and domicile.

Join us for a lively, interactive workshop where we will be discussing moving in retirement.

Tuesday, December 5, 2023

6:00 PM – 7:30 PM

Annex Wealth Management Elm Grove Office | 12700 W Bluemound Rd, Elm Grove, WI

Join us for a lively, interactive workshop where we will be discussing moving in retirement. Many are considering moving before or in retirement. As you make your decision, we’ll give you several key points to consider before you make your move – and why you should know the difference between residence and domicile.

Thursday, December 21, 2023

6:00 PM – 8:00 PM

BROWSE EVENTS →