1. Earnings Reports & Is Funflation Over? 2. Jeopardy Recap | “Who Is…” 3. Annex’s Veterans On Staff. 4. UPDATE 5. Get Your Tax-Smart Strategy Review Today! 6. 60/40 Portfolio | …More Than The Fundamentals? | Employer Contributions & Savings Goals | Ask Us A Question! 7. Homes For Our Troops.

Special Recognition

Annex Wealth Management’s President and CEO Dave Spano was presented with The Seven Seals Award on Friday at our Elm Grove office!

The Seven Seals Award is the broadest and most inclusive award given by Employer Support Guard and Reserve (ESGR), and recognizes significant individual or organizational achievement, initiative, or support that promotes and supports the ESGR mission to develop and promote supportive work environments for Service members in the Reserve Components through outreach, recognition, and educational opportunities that increase awareness of applicable laws.

We thank Bob Strange, ESGR Employer Outreach Director, and Jim Malcolm, state chair for ESGR, for coming to our office to present Dave with this award.

Continuing to show his support for veterans, Dave in turn presented ESGR with a donation to Operation Finally Home, an organization that builds homes for veterans and first responders.

1 | Week In Review

Annex strongly believes in frequent and meaningful communication.

Each Friday after market close, our experts record the “Week In Review”- exclusive insights to help you stay on top of the latest financial news.

Earnings Reports & Is Funflation Over?

The mood of the markets has certainly changed. Are consumers beginning to tighten their belts? Annex Wealth Management’s Dave Spano and Brian Jacobsen discuss.

BACK TO TOP ↑

2 | Jeopardy Recap

Get the results from last week’s Jeopardy: “It’s Too Expensive To Have Fun?” and see where else prices jumped & how much people will pay for an experience.

The results are in from last week’s clue, During 2023, this artist holds the record for most expensive concert ticket:

-

-

-

- 13% Who Is Beyonce?

- 83% Who Is Taylor Swift?

- 4% Who Is Maroon 5?

-

-

83% of you would’ve made Alex Trebek proud with the correct response of Taylor Swift! Sorry Mr. Springsteen, you didn’t make the board. Regardless of your music choice or NFL team you follow, the numbers don’t lie, Taylor Swift’s ongoing The Eras Tour came in as the most expensive concert ticket at $14,000… yes, 3 zeros! An article in the Wall Street Journal recently highlighted the rising cost of live entertainment in 2023 including concerts, live sporting events and theme-park visits.

Nearly 60% of Americans report having to cut back on live entertainment this year because of rising costs. In 2022 the cost of admission and fees increased more rapidly than the prices of food, gas and other staples and they don’t appear to be slowing down. Americans are on track to spend almost $95 billion in 2023 on tickets to spectator entertainment including movies, live entertainment & sporting events, up 23% from 2022.

Live music specifically has faced “supercharged” increases in ticket prices due to strong demand from consumers who are willing to belly up and pay. Music executives credit the marketing power of social media and the globalization of pop music complements of streaming services available for the increase. Record attendance is being set everywhere and everything’s sold out.

Some speculate families are using money saved during the pandemic (by not attending events) to afford the increase in costs to attend memorable performances, but how long will the funds last? The startling rise in rates to have fun has triggered a phenomenon analysts have dubbed “funflation.” You can now officially add the term “funflation” to your vocabulary.

Source: wsj.com/economy/consumers/its-getting-too-expensive-to-have-fun-a59e9df8

BACK TO TOP ↑

3 | Did You Know?

Did you know Annex has multiple Veterans on our staff?

Did you know Annex has multiple Veterans on our staff? As we celebrate Veteran’s Day, Annex would like to thank our Veterans we have on staff:

Kent Halleen

-

- USMC, Sergeant, Infantry

Brandon Lehman

-

- Army Reserves, Captain, Civil Affairs

Alex Suarez

-

- Army Reserves, 2nd Lieutenant, Military Police

Brady Michaelis

-

- Army National Guard, 2nd Lieutenant, Engineer Corps

Jon Freidl

-

- Army National Guard, Specialist, Engineer Corps

Those who live in freedom will always be grateful to those who helped preserve it.

Thank you, Veterans.

BACK TO TOP ↑

4 | MoneyDo

Double Check Your Tax Planning: Are Roth Conversions Beneficial For You?

There’s no doubt taxes are at the forefront of many people’s minds, especially as we get closer to the looming sunset of the Tax Cuts and Jobs Act at the end of 2025. Proactive tax planning allows us to decide when we pay taxes and at what rate.

This Week’s MoneyDo: Double check your tax planning to see if Roth conversions could be beneficial for you.

One way to use these low tax rates is through Roth conversions. A Roth conversion is where you take funds from a pre-tax retirement account (ex: 401(k) or IRA) and intentionally pay the taxes now. Funds transferred into a Roth IRA will grow tax-free and can be withdrawn tax-free in the future.

Pre-tax retirement accounts are eventually subject to required minimum distributions (RMDs). Depending on the year in which you were born, your RMD age could range from 70½ to 75. Additional income from RMDs may push you into a higher tax bracket in the future. However, Roth accounts aren’t subject to RMDs during your lifetime.

Who might be a good fit for a Roth conversion? Anyone who believes they’ll be in a higher tax environment later in life. For example, if you’ve just retired and haven’t yet started social security, you may be in a low tax bracket now.

However, later once social security is active and you must take RMDs from your pre-tax retirement accounts, you may be in a higher tax bracket. We also know tax rates in general are slated to rise in the future, as mentioned above.

Additionally, anyone who’s interested in leaving a tax-efficient legacy to heirs might explore Roth conversions. You can prepay the taxes during your lifetime, allowing your heirs to inherit tax-free dollars, which’s particularly valuable after the passage of the Secure Act.

The Secure Act requires most inherited retirement accounts to be fully liquidated within 10 years. If your heirs are expected to be in a higher tax environment than you currently are, a significant portion of their inheritance could be lost to taxes when they’re forced to fully distribute the inherited account in a compressed timeframe.

What’re the benefits of a Roth conversion? Taking pre-tax dollars out in a low tax environment will reduce future RMDs and the taxes associated with them, benefiting you by reducing the total amount of taxes you pay throughout your own lifetime.

Roth conversions also act as a hedge against the compressed single tax brackets for the surviving spouse. For example, when spouse 1 passes away, spouse 2 may inherit their retirement account and the RMDs which come along with it. The single tax brackets are more compressed than the married filing jointly tax brackets, meaning income will be subject to a higher tax rate more quickly than it would if the taxpayer was able to file jointly.

Lastly, Roth conversions can be used to create a more tax-efficient legacy as explained above.

Roth conversions can be used with a multi-year plan where you convert a portion of your pre-tax retirement accounts to Roth over several years to strategically fill up lower tax brackets. There’s no one-size-fits-all recommendation, so contact the team at Annex Wealth Management today to see if Roth conversions might be a good fit for your unique situation.

Safeguard Your Wealth. Get A Tax-Smart Strategy Review.

BACK TO TOP ↑

5 | Get Started With Annex

Get Your Tax-Smart Strategy Review Today!

Get a real assessment of your current tax strategy, including areas you might want to consider. Let our planning team create an Annex Wealth Management Tax-Smart Strategy Review for you!

Build A Tax-Smart Legacy With Our Team.

GET STARTED→

BACK TO TOP ↑

6 | Ask Annex

CLICK HERE TO ASK US A QUESTION →

BACK TO TOP ↑

7 | Annex In Action

Annex Wealth Management was a military sponsor & participated in the Lippert Charitable Golf Outing benefiting Homes For Our Troops.

Homes For Our Troops builds and donates specially adapted custom homes nationwide for severely injured post- 9/11 Veterans, to enable them to rebuild their lives.

Most of these veterans have sustained injuries including multiple limb amputations, partial or full paralysis, and/or severe traumatic brain injury (TBI).

Annex Exclusive

Tax Planning In Uncertain Times

Get the Annex Wealth Management Year-End Tax Planning Guide. It will help you decide if you should update, eliminate, or calibrate your 2023 Tax Plan.

Get Your Tax Planning Guide →

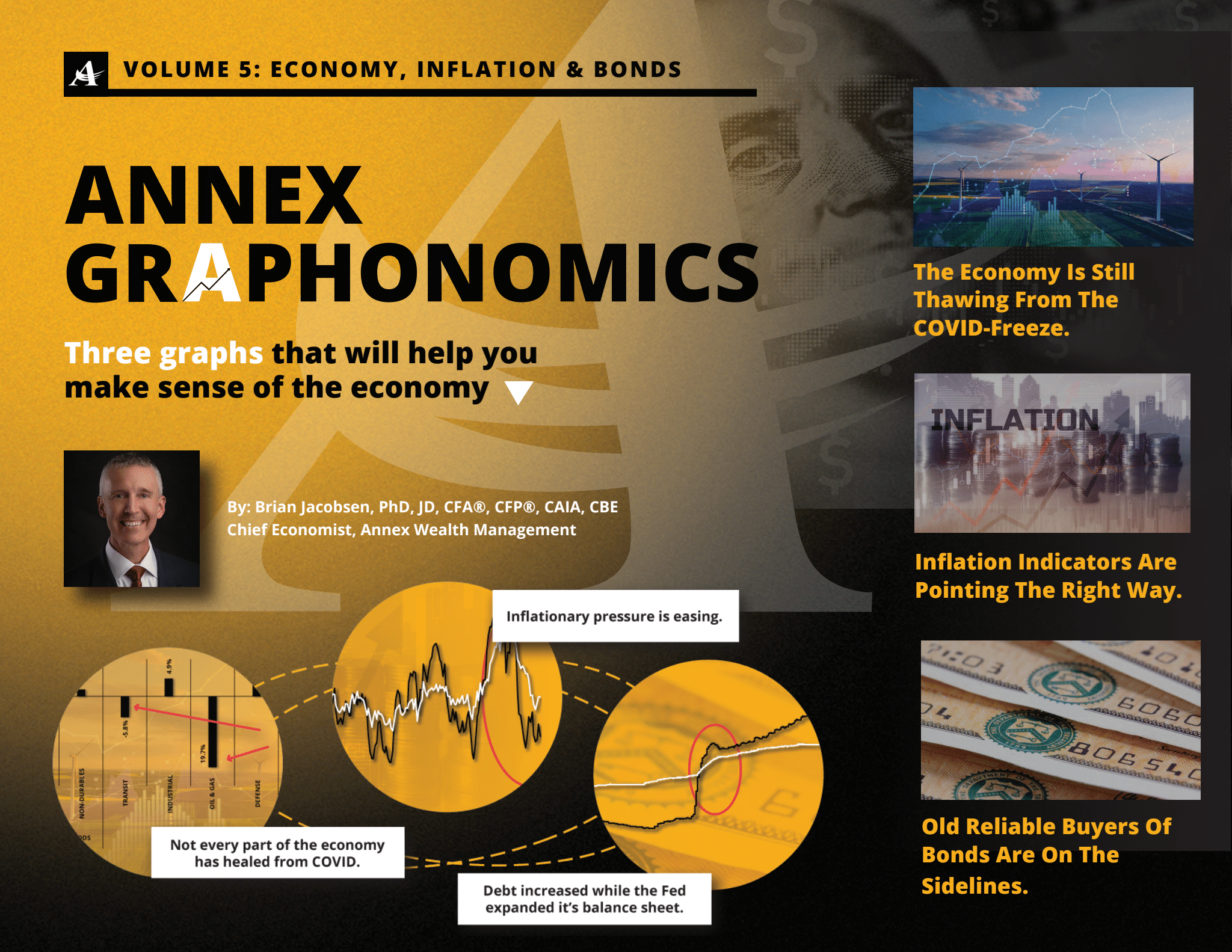

Graphonomics

COMING SOON! Graphonomics Volume 6!

Be in the know & get your copy of Graphonomics Volume 5 before Volume 6 is released!

Events & Webinars

NAPLES | Treatment of QDRO Distributions Post-Divorce

NAPLES | Navigating Uncertainty

NAPLES | Branch Grand Opening

WOMEN & WEALTH | 8 Tips for Smarter Charitable Giving

ELM GROVE | Moving In Retirement

WOMEN & WEALTH | Moving In Retirement

BACK TO TOP ↑