1. Winners, Losers & GDP. 2.Legendary Pfister Spirits. 3. Poll Response | Planning With Your Pet In Mind. 4. Avoid These Estate Planning Mistakes. 5. Get Your Tax-Smart Strategy Review Today! 6. Register Now For Event: MEQUON | Are Annuities Worth It? 7. Roth vs 403(b) | Investing An HSA | Combining Assets | Keeping Cash At Home | Ask Us A Question!

1 | Week In Review

Annex strongly believes in frequent and meaningful communication.

Each Friday after market close, our experts record the “Week In Review”- exclusive insights to help you stay on top of the latest financial news.

Winners, Losers & GDP

Another negative week, with the S&P 500 down nearly 3%. GDP and Earnings Reports moved the markets. Annex Wealth Management’s Dave Spano and Brian Jacobsen discuss.

BACK TO TOP ↑

2 | Did You Know?

Did you know The Pfister Hotel’s rumored to be haunted?

Did you know The Pfister Hotel’s rumored to be haunted? A renowned gem in downtown Milwaukee, The Pfister Hotel opened in 1893 and has been a member of the Historic Hotels of America since 1994. Originally purchased for $200 by Guido Pfister, the plot of land was transformed into The Pfister Hotel costing $1 Million upon initial completion.

At the height of Prohibition, Guido’s son, Charles, opened “English Room,” where he served his special concoction of “Indian Punch.” Charles Pfister created such a following (pre-social media) he bottled his Indian Punch and sold it nationwide. He suffered a stroke resulting in him selling The Pfister to his friend, Ray Smith, who later sold it to Ben Marcus. Marcus had plans to overhaul much of the hotel and restore it back to its original beauty.

Following their purchase of the hotel in 1962, the Marcus family learned the art collection within the hotel was worth more than the hotel itself and it’s currently the world’s largest hotel collection of Victorian art.

Since their purchase of The Pfister, it has undergone renovations including the addition of the tower in the 60’s. 23 floors up, the “Crown Room,” situated at the top, was Milwaukee’s premier nightclub over the following decades. Blu, a cocktail lounge, now stands in its place and serves as one of the most popular martini bars in Milwaukee, offering panoramic views of Lake Michigan and downtown (Source).

Celebrating 130 years, The Pfister has brought history, a celebration of art and prestige to Milwaukee. However, 130 years is a lot of time to collect the spirits of Milwaukee’s past; not necessarily the happy hour kind (Source).

The Pfister has been and continues to host MLB & NBA teams, other athletes, celebrities & rock stars. MLB players and other guests report electronic devices unexplainedly turning on & off, hearing unexplained footsteps & feeling a supernatural presence in their rooms.

-

-

- Over summer Brent Rooker, left fielder for the Oakland A’s, encountered some strange happenings of his own. One night before a three-game series against the Brewers, he was kept awake by his TV turning on and off & changing channels on its own throughout the night. Brent was aware of encounters other players had during previous stays (Source)

-

-

-

- Mookie Betts with the L.A. Dodgers refused to stay at The Pfister over the summer and opted for an Airbnb to avoid any possible spirit encounters. He states he doesn’t believe in ghosts but doesn’t want to find out he’s wrong. Previous stays at The Pfister have been uneventful, however, he couldn’t get any sleep due to the “noises” he would hear (Source).

-

-

-

- While playing for the Nationals, Bryce Harper laid out his shirt and pants on a table one night before waking up to his clothes scattered on the floor and the table on the opposite side of his room against a wall.

-

-

-

- Another time former Rangers pitcher, Colby Lewis, reported he saw a “skeletal apparition” around 1:30 a.m. which scared him so much he visited the team’s chaplain the following day and missed a radio appearance (Source).

-

-

-

- In 2021 MLB published an article naming The Pfister as “one of the most haunted lodgings in the country.” ESPN the Magazine gathered plenty of hotel ghost stories from ballplayers, but Michael Young’s may top the list:

-

“Listen, I’m not someone who spreads ghost stories, so if I’m telling you this, it happened,” Young said. “A couple of years ago, I was lying in bed after a night game, and I was out. My room was locked, but I heard these footsteps inside my room, stomping around. I’d heard all these stories about this hotel, so I was wide awake at that point. And then I heard it again, these footsteps on the floor, so I yelled out, ‘Hey! Make yourself at home. Hang out, have a seat, but do not wake me up, OK?’ After that, I didn’t hear a thing for the rest of the night. I just let him know he was welcome, that we could be pals, that he

could marinate in there for as long as he needed to, just as long as he didn’t wake me up

(Source).”

-

-

- Previous Milwaukee Brewer, Carlos Gomez, reports hearing voices while staying in The Pfister, with the most extreme happening when he got out of the shower and heard static playing on his iPod. He grabbed the device, which then changed to a new song. He raced out of the room and into the lobby before getting his pants on.

-

One person having an encounter is one thing, but what happens when there’re multiple witnesses to an unexplained event?

-

-

- One evening when the Cardinals were in town, Carlos Martinez & Marcell Ozuna both claimed to have seen a ghost. “We are here in Milwaukee. I just saw a ghost. In Ozuna’s room, he saw another one. We are all here. We are all in one room and we are stuck here. We are going to sleep together… If the ghost shows again, we are all going to fight together (Source).”

-

One person seeing a ghost: Who knows, could just be nerves. Two? That makes a bit more compelling argument (Source). These’re just a few of many reported encounters from teams staying at The Pfister. Guests believe these strange happenings may be the resident spirit of the hotel’s founder (Source).

In 2018 Annex Wealth Management added a new location and opened a branch within The Pfister Hotel on the first floor on Wisconsin Avenue. Regardless of what you may believe, next time you’re in downtown Milwaukee, be sure to stop by and see us and enjoy a legendary Pfister spirit.

BACK TO TOP ↑

3 |Poll Response

Get the results from last week’s poll “Is Your Pet Included In Your Estate Plan?” & find out more about planning with your pet in mind.

The results are in from last week’s pole on pets & estate planning:

-

-

-

- 41% of readers have included their pets in their estate plan

- 18% of readers haven’t included their pets in their estate plan

- 41% of readers don’t have pets

-

-

As of 2023, 86.9 million US households own a pet. They’re our companions, providing love & support. In many cases they’re total and complete family members. Through inquiries and in person meetings with Annex’s Wealth Managers and Estate Planning Team, it’s clear pets are a passion asset.

We want to make sure they’re well taken care of when we’re not around. Pets can be included as part of your estate plan when deciding what happens to them in the case of death or incapacity.

Pets can be expensive and time consuming to maintain. Depending on the type of pet, the financial and time commitment can differ between an African Grey Parrot, Siamese cat, Great Dane or Quarter Horse. Having conversations about what happens to pets upon death or incapacity can include making sure you choose the right type of person to fit your pet’s needs.

For people who love their pets and care deeply for them it’s not unusual to have something set up to take care of them upon death or incapacitation. It’s estimated more than 500,000 pets are euthanized annually because their pet parent died or became disabled.

You’ll want to think of including your pet as a part of your estate plan, which brings together the right decisions and documents to take care of the people, pets and things you love at death or incapacitation.

In the event of incapacity, it’s good to have the right documentation in place. Considering a pet care authorization form or a wallet card saying who you’re designating to take care of your pet. You can also include a provision in your financial power of attorney to make sure someone has the authority to pay for the expenses of your pet.

Expenses such as food and medical care are something to consider too. A living trust or bequest in a Will can determine who’ll take your pet and a sum of money can be left for the care. It’s possible to create a pet trust depending on the state you live in.

Pets can often outlive owners. When creating a pet trust be sure to consider what happens if there’s money left at the end of the pet’s life and where the remaining funds should go.

For pet owners, the best spot to start is with your financial advisor and estate planning attorney to discuss your intentions for your pet, and to put an estate plan in place.

BACK TO TOP ↑

4 | MoneyDo

Avoid These Estate Planning Mistakes

Innocent blunders can have a big, and most often negative, impact on your best estate planning intentions. Avoiding those blunders is key to ensuring an estate plan operates as smoothly as intended. The following is a list of things to avoid to ensure your estate plan operates as smoothly as possible.

- Not Having an Estate Plan. Death and taxes are two of the few absolutes in life. Having an estate plan makes sure you effectively plan for both. Effective estate planning includes acknowledging who can act on your behalf, even in circumstances where you’re still living but unable to manage your affairs.

- Using Do-It-Yourself Software. There’s no doubt lawyers can be expensive, but the cost of solid legal representation is minimal compared to the expense of family fights, litigation, or legal costs your heirs could spend fixing a bad estate plan concocted by a bot.

- Creating Legally Invalid Documents. An estate plan is comprised of multiple documents, each with different requirements for witnesses or notaries. Often, especially with do-it-yourself estate plans, the documents weren’t properly executed and therefore aren’t legally valid. Therefore, it’s important to take the time to review an estate plan and make sure all documents were executed properly.

- Relying on Your Neighbor’s “Legal” Advice. No two estate plans are alike. Your neighbor may have all sorts of information about what they did for their estate planning, but their financial situation is likely very different from yours. Avoid any estate planning steps without first discussing your personal situation with an attorney to determine the best course of action to meet your needs.

- Naming the Wrong Individual as Power of Attorney, Executor, or Trustee. You’d think selecting who’s responsible for your financial affairs as your health declines and after you die would be one of the biggest reasons to create an estate plan, but unfortunately it doesn’t always get the consideration it deserves. The individuals you name within your estate plan should be trustworthy, financially responsible, and good communicators who can let all beneficiaries know what’s going on throughout the process.

- Failing to do the Follow-Up Work. After you sign your estate plan documents, you’ll still have some work to do. Your attorney likely gave you instructions for updating beneficiary designations or changing how an account is registered. If you don’t complete the follow up work, the estate plan won’t work as intended.

- Failing to Review and Update Your Estate Plan. Estate plan documents are valid until they’re revoked or superseded by new documents. Your Will from 30 years ago is still legal even if you can’t recall what it said. Meaning if you have new plans for your assets or new family members, you need to update your estate plan. Estate tax and income tax laws have changed dramatically in the last 20 years, so any plan done before 2005 likely needs to be reviewed and updated to bring it current with the laws in place today.

- Storing Plan Documents in an Inaccessible or Unreliable Location. A safe deposit box works, but only if someone other than you can get access to it. Other location ideas include personal lock boxes or a home safe, but again, make sure someone else has the key or combination. It’s also a good idea to provide copies to family as an additional backup.

- Misunderstanding Your Estate Plan. Often, we’ll work with people who forget or never had a good understanding of how their estate plan works. Don’t be afraid to ask questions of your attorney and take notes about your plan. Your attorney is a source of extensive information about the ins and outs of your estate plan, use them.

- Not Communicating Your Estate Plan. Chances are your circumstances will eventually require you hand off your day-to-day finances to someone else. Communicating the details of your finances and your estate plan will help ensure the transition is smooth. It’s a gift you can give your power of attorney, executor, or trustee: a simple process which avoids mundane tasks like hunting through decades of files to find out where your bank account is held.

BACK TO TOP ↑

5 |Call To Action

Get Your Tax-Smart Strategy Review Today!

Get a real assessment of your current tax strategy, including areas you might want to consider. Let our planning team create an Annex Wealth Management Tax-Smart Strategy Review for you!

BACK TO TOP ↑

6 | Register Now!

Annex Wealth Management Mequon Office | 12200 Corporate Parkway, Mequon, WI

Annuities are one of civilization’s oldest financial instruments. But what are they, and do their benefits outweigh their pitfalls?

Annex Financial Planners discuss if and when an annuity might make sense – and potential dangers of annuity ownership.

Tuesday, November 7, 2023

6:00 PM – 7:30 PM CST

BACK TO TOP ↑

7 |Ask Annex

BACK TO TOP ↑

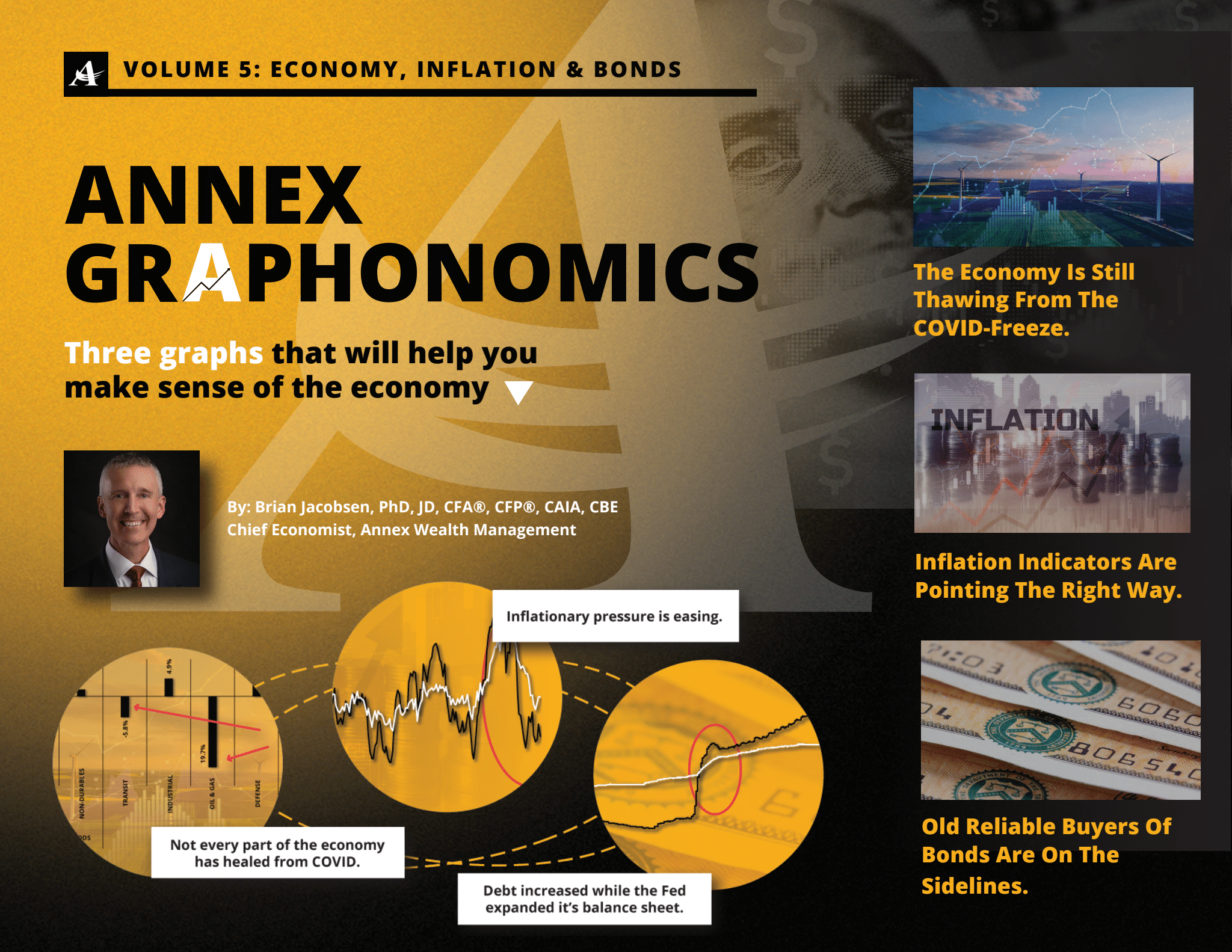

|Graphonomics

Graphonomics Volume 5 Available Now!

| Annex In Action

Through the Annex Charitable Foundation, Annex Wealth Management participated in the KMA Cares Golf Outing Fundraiser to benefit Coaches vs. Cancer. Coaches vs. Cancer is a nationwide collaboration between the American Cancer Society and the National Association of Basketball coaches.

Members of the KMA Foundation came together to host an amazing event for the community, while raising funds for research, increasing cancer awareness & promoting healthy living (Source).

The Annex Charitable Foundation, Inc.’s primary purpose is to provide financial support to existing charitable “difference makers” that support the local communities in Wisconsin. This financial support will be given to organizations for projects that add energy and vitality to the communities they serve & provide support to a variety of charitable needs (Source).

| Events & Webinars

Annex Wealth Management Mequon Office | 12200 Corporate Parkway, Mequon, WI

Annuities are one of civilization’s oldest financial instruments. But what are they, and do their benefits outweigh their pitfalls?

Annex Financial Planners discuss if and when an annuity might make sense – and potential dangers of annuity ownership.

Tuesday, November 7, 2023

6:00 PM – 7:30 PM CST

Shula’s Steak House | 5111 Tamiami Trail North

In this CLE credit event, we’ll discuss specific uses of QDROs, their structure, and specific issues you may face when working on them.

The presentation will also review follow-through recommendations for the non-participant spouse, as well as issues to consider and the additional needs of the alternate payee.

We’ll also consider matching the A/P’s financial needs to types of investments, and what to expect.

**This event is for attorneys looking to earn 1.5 hours of CLE credit.**

Lunch is provided.

Tuesday, November 14, 2023

11:00 AM – 1:00 PM EST

M Waterfront Grille | 4300 Gulf Shore Blvd N

Navigating The Markets: Strategies In An Ever-changing Tax Environment

As rates, inflation, and the dollar fluctuate, have you calibrated your financial plan, including how your tax and wealth transfer planning?

In this interactive presentation, Amy Kiiskila, JD, CFP®, CPA, CLU® and Brian Jacobsen, PhD, JD, CFA®, CFP®, CAIA, CBE will provide an economic and market update – and present planning scenarios while discussing strategies that address key concerns, like cash management and charitable planning.

Lunch is provided.

Wednesday, November 15, 2023

12:00 PM – 1:30 PM EST

Annex Wealth Management Naples Branch | 4901 Tamiami Trail North

Our Naples branch has a new home! If you’re in the Naples area, come check it out and join us! Food & drink will be provided!

Thursday, November 16, 2023

2:00 PM – 5:00 PM EST

Annex Wealth Management Elm Grove Office | 12700 W Bluemound Rd, Elm Grove, WI

There are so many ways to be generous! In this workshop an Annex estate planning attorney and financial planner explore different ways to give. From donor advised funds to qualified charitable donations to trusts; we will introduce current strategies where it’s a win/win: for you and the charity!

Thursday, November 16, 2023

6:00 PM – 8:00 PM

Annex Wealth Management Elm Grove Office | 12700 W Bluemound Rd, Elm Grove, WI

Many are considering moving before or in retirement. As you make your decision, we’ll give you several key points to consider before you make your move – and why you should know the difference between residence and domicile.

Join us for a lively, interactive workshop where we will be discussing moving in retirement.

Tuesday, December 5, 2023

6:00 PM – 7:30 PM

Annex Wealth Management Elm Grove Office | 12700 W Bluemound Rd, Elm Grove, WI

Join us for a lively, interactive workshop where we will be discussing moving in retirement. Many are considering moving before or in retirement. As you make your decision, we’ll give you several key points to consider before you make your move – and why you should know the difference between residence and domicile.

Thursday, December 21, 2023

6:00 PM – 8:00 PM

BROWSE EVENTS →