1. Fed Meeting Next Week, Not Expected To Raise Rates 2. How’d You Finance Your College Education? 3. Get Your Graphonomics: Volume 4. 4. The Difference Maker Of The Game. 5. Establish The Gift Of Education. 6. The 4% Rule | Liquidity | Tax Loss Harvesting | Keeping A 401(k) At Your Previous Company | Ask Us A Question! | 7. Supporting Adult Children.

1 | Week In Review

Annex strongly believes in frequent and meaningful communication.

Each Friday after market close, our experts record the “Week In Review”- exclusive insights to help you stay on top of the latest financial news.

The Fed is not expected to raise rates in next week’s meeting, and they may be done for the year – but don’t take that to the bank. Annex Wealth Management’s Dave Spano discusses.

2 |Poll Recap

Find out the results of our latest poll, “How’d You Finance Your College Education,” how your answer compares to other Axiom readers and how America got to where we’re at now with student loan debt.

The results are in from our latest poll question:

How did you finance (or are currently financing) your college education?

-

-

-

-

- Cash From Personal Savings & Work 58%

- Assistance From Family Members 15%

- Federal Financial Aid 15%

- 529 College Savings Plan 10%

- Grants & Scholarships 2%

-

-

-

With the reinstatement of student loan payments looming on the doorstep, it’s eye-opening to see 15% of our readers who took the poll may be affected, while 58% have used cash from personal savings and working to help finance their college education. For many Americans, student loan debt continues to be an issue, but where’d the debt originate from? CNN reports, “Millions of Americans have student loan debt, amassing to more than $1.6 trillion by the end of last year, according to the Federal Reserve Bank of New York.

The debt is believed to be a result of the decades-long explosion in borrowing coupled with soaring education costs.” In addition, Americans under the age of 30 appear to be more likely to be carrying student loan debt than their parents, adding to the financial burden on younger generations.

The debt burden shouldn’t solely be viewed as a 30-something issue, as Americans 50 years and older play a role as well by owning nearly a quarter of the student loan debt. The multigenerational impact can be compounded with the expectation of children following in their parent’s footsteps to go to college or becoming a first-generation family member to attend college, using student loans to support their education.

Although college graduates can earn more than $25,000 annually than individuals without a degree and a high school diploma, these well-paying jobs are often paired with increased student loan debt.

As college costs continue to rise, they’re outpacing the inflation rate. Attending a public, four-year institution in 1968-1969 would cost on average $1,545 annually, including room and board, tuition and fees, compared with $29,033 annually in 2020-2021.

If tuition remained parallel with inflation, it would alarmingly be around $12,000 annually.

Student loan debt in America hasn’t always been in crisis mode but understanding the path of how we got here can highlight the runway to the current, unintended consequence.

A few cliff-notes on student loan debt and how America got to where we’re now:

-

-

-

-

- Beginning in 1958 the first federal initiative, The National Student Loan program, was the first federal student loan program created from the National Defense Education Act for students implemented to focus on improving science, math and engineering skills during the Cold War.

-

-

-

-

-

-

-

- The Higher Education Act of 1965 opened the doors for additional access to a college education by removing limitations on the area of study and creating a new type of relationship between banks, college campuses and the federal government with the Guaranteed Student Loan program, modeled off the home mortgage program.

-

-

-

-

-

-

-

- In turn, a new and unanticipated issue surfaced: a degree can’t be taken away for default on a student loan payment like a home can be repossessed for non-payment.

-

-

-

-

-

-

-

- In the1970’s federal loans increased quickly with the formation of new personal loans and the pressure to cut taxes, creating Sallie Mae, introducing private student loans allowing for financial aid products to be available to for-profit and nonprofit companies allowing for the rise of private student loans.

-

-

-

-

-

-

-

- The rising cost of tuition required students to need more money to complete their education, and when personal federal student loan amounts were maxed out… private loans supplemented the difference. Colleges and universities responded by increasing tuition.

-

-

-

-

-

-

-

- The William Ford Direct Student Loan program replaced the Guaranteed Student Loan Program in 1992 to correct the problems caused by previously modeling student loans on mortgages.

-

-

-

-

-

-

-

- The US Department of Education provided loans directly to students instead of reassuring banks they’d be reimbursed.

-

-

-

-

-

-

-

- Following the 1990’s several initiatives were implemented to reduce the default rate on student loans focusing on capping payments in one way or another to mirror the borrower’s income.

-

-

-

Regardless of your age, if you have some financial obligation to student loan repayment, you’re a contributing participant to the nearly $1.6 trillion in student loan debt. Student loan debt is currently the second highest consumer debt category, following mortgage debt and can postpone major life milestones such as purchasing a home, getting married or starting a family.

Working with a wealth manager to unpack current student loans repayment options and to proactively plan for other generations to attend post-secondary education, can help to ease the financial burden on yourself and your loved ones. Finish 2023 Strong. Update Your Plan Now.

BACK TO TOP ↑

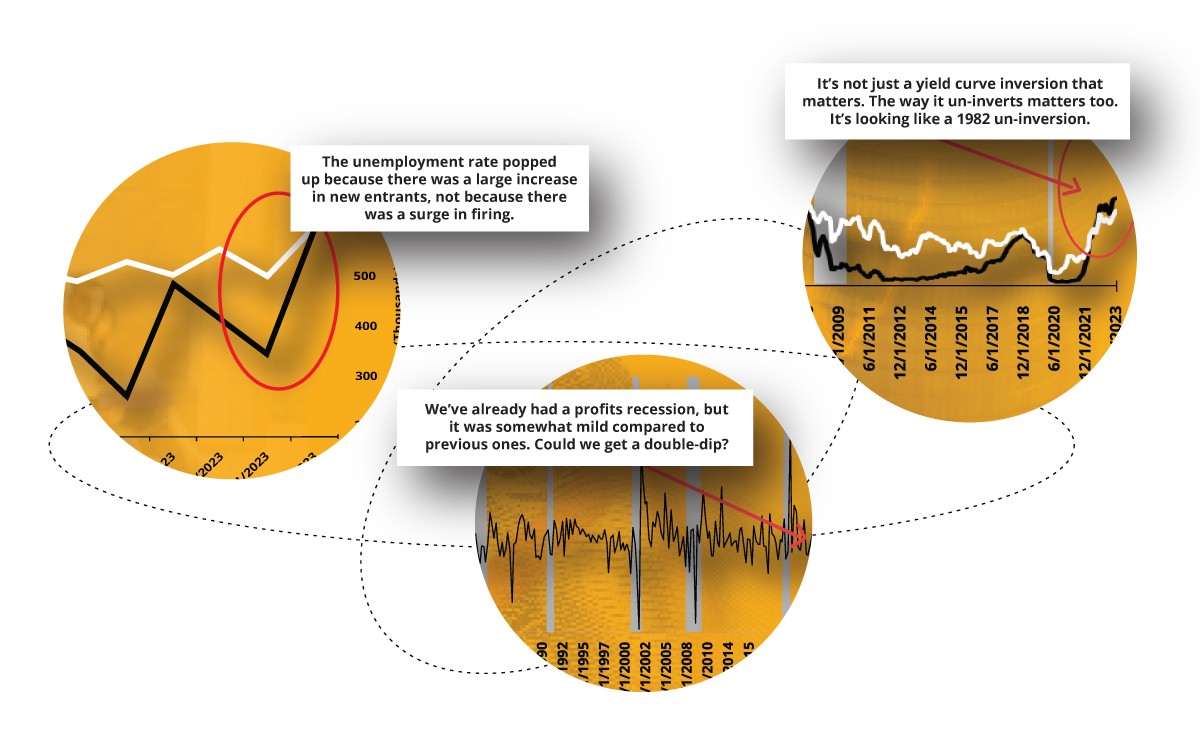

3 | Download Graphonomics Today!

Get Your Graphonomics: Volume 4

The average person today has access to more data than ever before. Somehow, that seems to have resulted in less clarity instead of more understanding.

Annex Wealth Management is dedicated to assisting as you seek to make truly informed decisions. Annex Graphonomics will be a regular offering of 3 graphs that should help you get a firmer grasp on where we are and where we’re headed.

BACK TO TOP ↑

4 | Listen To

The Difference Maker Of The Game

Brewers vs. Marlins | September 14, 2023

Click to listen!

Check out the full archive HERE.

BACK TO TOP ↑

5 | MoneyDo

Establish The Gift of Education

Financial planning for a student’s college education can begin as soon as the child has a social security number and can be a family affair. Using a hybrid approach can help to offset the cost of financing a college education using grants and scholarships, student borrowing, student income and savings, parent borrowing, parent income and savings and assistance from relatives and friends.

MoneyDo: Initiating a family discussion can be the start to an informational, no pressure discussion to set expectations and educate family members on how everyone can play an active role in supporting your future college student.

As of June 2023, the average cost of attendance for a student living on campus at a public 4-year state institution has risen to $104,108, and $223,360 for a private, 4-year nonprofit university (Source). Using a 529 College Savings Plan can be an excellent method to involve yourself, and your student’s network in having an active role in supporting your future college student.

Gift contributions and/or establishing a 529 College Savings Plan can be made by anyone and done in all 50 states. Different options for Plans are available to meet comfort levels such as direct sold college savings programs (just click and sign up for free) or advisor guided college savings programs (fees may be applied). The total allowance of gifts contributed annually can vary depending on who the gift giver is, beneficiaries, how gifts are disbursed and marital status.

Being proactive in these family discussions with family and the intended beneficiaries to feel for interest and to set expectations can set the guidelines for buy in. Be sure to reach out to your wealth management team for assistance with any questions. Consider who can be impacted by your giving.

Refresh Your Financial Future. Calibrate Your Financial Plan.

BACK TO TOP ↑

6 |Ask Annex

The 4% Rule | Liquidity | Tax Loss Harvesting | Keeping A 401(k) At Your Previous Company

7 | What’s Playing

As adult children graduate and leave the nest to head off to college, it can feel comforting for parents to offer financial support here and there to help them make ends meet. However, this can quickly come to a head from the accumulation of cash that parents have given their adult student resulting in the decision to pull back and stop the financial support.

Please click below to join Wealth Manager, Amy Bremmer, MBA, CFP®, to discover how supporting adult children financially (even as simple as gas or groceries) may be negatively affecting your own retirement and putting your financial health at risk. This is especially critical to evaluate today as rates continue to fluctuate.

Rates Have Changed. Have You Refreshed Your Strategies?

BACK TO TOP ↑

| Quote of the Week

Being prepared can help reduce fear and anxiety, providing you with the tools, skills & knowledge needed to succeed and achieve your goals.

Refresh Your Financial Future. Calibrate Your Financial Plan.

BACK TO TOP ↑

| Annex In Action

As part of Annex’s ongoing commitment to giving back to our community, employees volunteered to tend to the Green Power Garden for the Hope Center of Waukesha. The Green Power Garden is a 1-acre organically farmed plot of land growing produce for homeless and low-income populations in Waukesha County.

It was a day of hard work picking vegetables, tying up tomatoes and weeding, but was also very rewarding to make a positive impact as a team. Together, Annex’s team harvested 151 lbs. of produce the first day and 267 lbs. of produce the second day some of which the Hope Center of Waukesha served that evening for dinner.

| Events & Webinars

Join us every Third Thursday for an interactive presentation where we will be discussing key financial topics.

Annuities are one of civilization’s oldest financial instruments. But what are they, and do their benefits outweigh their pitfalls? Annex Financial Planners discuss if and when an annuity might make sense – and potential dangers of annuity ownership.

Thursday, September 21, 2023

6:00 PM – 8:00 PM CDT

REGISTER →

Concordia University Wisconsin – 12800 N Lake Shore Dr, Mequon, WI 53097

Annex Wealth Management’s “Navigating The Markets” is an interactive presentation focused on providing information and insight on today’s economy.

Join Annex Wealth Management’s Brian Jacobsen and Dave Spano as they walk you through where we are and where the Annex Investment Team believes we’re headed.

In addition to taking your questions, Brian and Dave will discuss:

• Headwinds for the economy and markets

• Whether the long-awaited recession will ever happen

• The historical significance of today’s economy

• What you can do to calibrate your portfolio

Tuesday, September 26, 2023

6:00 PM – 7:30 PM CDT

Madison Marriott West – 1313 John Q Hammons Dr, Middleton, WI 53562

Annex Wealth Management’s “Navigating The Markets” is an interactive presentation focused on providing information and insight on today’s economy.

Join Annex Wealth Management’s Brian Jacobsen and Mark Pent as they walk you through where we are and where the Annex Investment Team believes we’re headed.

In addition to taking your questions, Brian and Mark will discuss:

-

-

- Headwinds for the economy and markets

- Whether the long-awaited recession will ever happen

- The historical significance of today’s economy

- What you can do to calibrate your portfolio

-

Tuesday, October 3, 2023

6:00 PM – 7:30 PM CDT

Sharon Lynne Wilson Center for the Arts – 3270 Mitchell Park Dr, Brookfield, WI 53045

Annex Wealth Management’s “Navigating The Markets” is an interactive presentation focused on providing information and insight on today’s economy.

Join Annex Wealth Management’s Brian Jacobsen and Dave Spano as they walk you through where we are and where the Annex Investment Team believes we’re headed.

In addition to taking your questions, Brian and Dave will discuss:

-

-

- Headwinds for the economy and markets

- Whether the long-awaited recession will ever happen

- The historical significance of today’s economy

- What you can do to calibrate your portfolio

-

Thursday, October 5, 2023

6:00 PM – 7:30 PM CDT

Fox Cities Performing Arts Center – 400 W College Ave, Appleton, WI 54911

Annex Wealth Management’s “Navigating The Markets” is an interactive presentation focused on providing information and insight on today’s economy.

Join Annex Wealth Management’s Brian Jacobsen and Jeff Daye as they walk you through where we are and where the Annex Investment Team believes we’re headed.

In addition to taking your questions, Brian and Jeff will discuss:

-

-

- Headwinds for the economy and markets

- Whether the long-awaited recession will ever happen

- The historical significance of today’s economy

- What you can do to calibrate your portfolio

-

Tuesday, October 10, 2023

5:00 PM – 6:30 PM CDT

WHY WE WALK

Thank you for helping us reach our fundraising goal! Together we can make a difference in the lives of those affected by ALS. Our team is committed to raising money to support people in our community with ALS and spread awareness of the urgency to find treatments and a cure. Please consider joining our team in the Walk to Defeat ALS® or choose a team member from the list and donate to our cause.

WHY WE NEED YOUR HELP

Every 90 minutes a person in this country is diagnosed with ALS and every 90 minutes another person will lose their battle against this disease. ALS occurs throughout the world with no racial, ethnic, or socioeconomic boundaries.

That’s why we’re participating in the Walk to Defeat ALS. To bring hope. To raise awareness. To provide resources and services to families free of charge. To help unlock the mystery of ALS and find the key to treatments a cure. Will you join us?

ABOUT ALS

Amyotrophic lateral sclerosis (ALS) is a progressive, fatal neuromuscular disease that slowly robs the body of its ability to walk, speak, swallow and breathe. The life expectancy of a person with ALS averages 2 to 5 years from the time of diagnosis.

ALS can strike anyone. Presently there is no known cause of the disease, yet it still costs loved ones an average of $250,000 a year to provide the care people living with ALS and their families need. Join the movement to provide help and hope today!

The Corners of Brookfield | 20111 W Bluemound Rd, Brookfield, WI 53045

Join us for the 3rd Annual Boos & Ghouls Night Out! This was a sold-out event last year so do not delay! Enjoy wine tastings and food pairings as you stroll the Corners of Brookfield, listen to the beautiful music provided by musicians from Elmbrook Schools, shop at various retailers who will give back to the Elmbrook Education Foundation & the Elmbrook Schools! Costumes are optional but encouraged!

Thursday, October 12, 2023

6:00 PM – 8:30 PM CDT

BROWSE EVENTS →