Axiom | Vol 285

Meet The Axiom®’s Guest Editor: Ryan Van Blarcom, MBA

My name is Ryan Van Blarcom, and I’m an Associate Wealth Manager for our Annex Ignite Team.

I help educate clients to better understand their financial goals now and in their future.

I graduated from the University of Minnesota-Duluth in 2018 with a degree in Finance and went on to get my MBA with Capella University. I recently started with Annex in the fall of 2021, and I could not be more excited to be here!

BACK TO TOP ↑

“One of my favorite parts about the Axiom is that it is simple, yet it provides the reader with plenty of detail. It keeps me updated on the different events, videos, or articles that Annex offers and is constantly teaching me new things to help provide our clients with a more satisfactory experience.“

– Guest Editor: Ryan Van Blarcom, MBA | Associate Wealth Manager

________________________________________

As expected, Fed Chairman Powell pivoted and announced a faster taper than previously planned as the Fed seeks to fulfill its dual mandate. What does that mean for inflation in the near term? Annex Wealth Management’s Dave Spano and Derek Felske discuss.

BACK TO TOP ↑

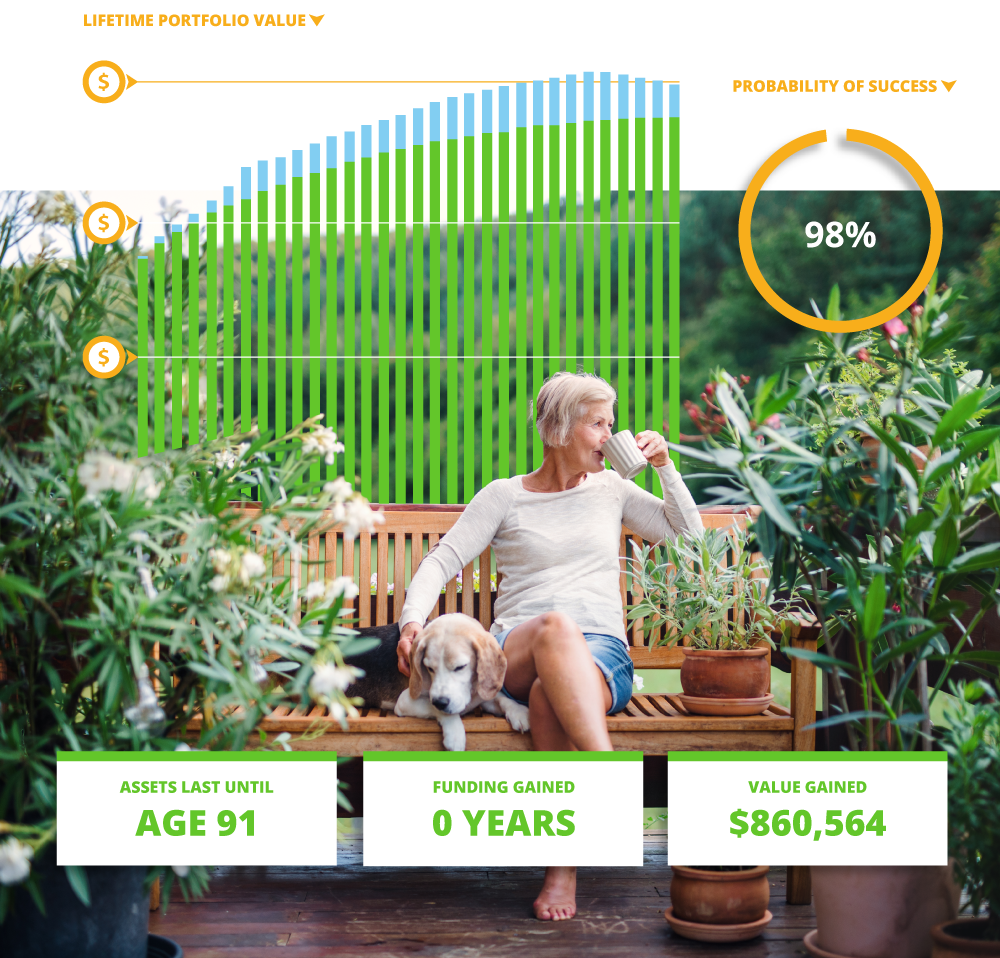

Poll Recap | What You Thought About Saving And Being Wealthy

A recent study shows that due to the pandemic our attitudes about saving and being wealthy have changed. Over the course of several weeks, we asked our readers some questions about what that means.

Week 1: Are you a saver or spender?

Only 7% of respondents admitted to being spenders. Others claimed to be savers, or a mix of both saver and spender. Most respondents answered: “I am responsible with savings – but like the ability to buy things if needed or wanted.”

Week 2: In the last year, which of the following did you splurge on:

According to this poll, respondents aren’t hosting many parties (7%), but they are traveling (32%), dining out (22%), attending shows (11%) and practicing self-care (13%). 15% answered “other”.

Week 3: Which number best describes what you think it takes to be wealthy?

There’s no question current inflation had an impact on responses – as most respondents believe you must hit the $3,000,000+ mark to truly be considered wealthy. The second-place response was $2,000,000.

According to an annual wealth survey by Charles Schwab, Americans surveyed pre-pandemic claimed it took $2.6 million to be wealthy. Post-pandemic, that number dropped 23%.*

Week 4: In your opinion, what would it take for you to be financially comfortable?

Many respondents were forward-thinking with their answers: 46% said having a retirement fund in place would make them feel financially comfortable, and 20% said having an emergency fund would. Other respondents wanted money to spend on things or experiences now: 18% said having the money for splurge items, without worry, would make them feel financially comfortable. 13% said if they had the money to vacation anytime, 3% answered other.

The pandemic has drastically changed the world, and our feelings on finance – however some things remain the same. According to the study, people were still twice as likely to say their primary source of happiness was relationships compared to money.

*https://fortune.com/2020/07/27/how-much-money-does-it-take-to-be-wealthy-definition-net-worth-finances-comfortable-coronavirus-pandemic-covid-19/

BACK TO TOP ↑

Financial Goals For The New Year

As 2021 is coming to an end, now is a great time to look at setting goals for 2022. You may be thinking about fitness or health goals. However, it is important to think about financial goals too.

Financial goals can range from reducing debt to increasing retirement savings. The process of goal setting can help you recognize where you are now and establish where you would like to be in the future. Put your goals in writing. If you’re married – involve your spouse. Work together – perhaps your spouse can help by acting as an accountability partner.

This week’s MoneyDo is to determine some goals for the new year. Here are some examples:

- Review retirement account contributions

A good rule of thumb is to contribute at least 10-15% of your pre-tax income every year. If you have fallen under this benchmark in the past, you may want to consider contributing more. Remember that the earlier you start saving, the more time you have for growth in your accounts.

- Monitor Credit Score/Report

Monitoring your credit is a good way to spot potential fraud. Look at recent inquiries from companies, accounts opened, and transactions. The activity you find on your credit report should reflect companies with which you currently have a relationship.

- Track Expenses

Keep track of your expenses for three or more months so you can establish a baseline of what you typically spend. If you know how much you truly spend, you will be far better equipped to establish and follow through with other essential financial goals.

- Establish or add to emergency fund

If you are still working, have you saved enough for a rainy day? It is important to have an emergency fund set aside. The account should have 3-6 months’ worth of living expenses. Set a goal to start building the balance of your emergency fund.

- Create and stick to a budget

Now that you have a better understanding of what you’re spending and saving, set up a budget or improve your existing one to include realistic numbers. Make sure you analyze your budget monthly to determine if you are meeting those goals.

- Manage debt

Are your current debt obligations financed at a reasonable interest rate? Now may be the time to set a goal to pay off high interest debt such as credit cards. What about low-interest debt? Mortgage rates have been near historical lows, and are likely to rise. Use discretion in deciding whether to pay down low interest debt – other financial priorities may be more important.

BACK TO TOP ↑

This week’s Ask Annex comes from Christie, who asks:

“Are there any last-minute year-end planning opportunities to consider regarding my current 401(k)?”

_________________

We asked Annex Wealth Management’s Tom Berkholtz, CFP®️:

If you’re planning on maxing your 401(k) for 2021, you will want to confirm you’re on track to do so. You may need to increase your contribution percentage on a remaining paycheck to accomplish this.

For the 2021 tax year, the 401(k)-contribution limit is $19,500. If you’re over the age of 50, your limit is $26,000. Generally, the 401(k)-contribution deadline is at the end of the calendar year, not your tax filing deadline.

Lastly, the end of the year is a good time to review your accounts beneficiaries including your 401(k), to make sure the information is current especially if there were any life changes, such as marriages, deaths, divorces, or children.

– Tom Berkholtz, CFP®️ | Financial Planning Specialist

Have a question for Annex? Submit it here!

BACK TO TOP ↑

BACK TO TOP ↑

KNOW THE DIFFERENCE MINUTE:

KNOW THE DIFFERENCE MINUTE:

ANNEX RADIO

BACK TO TOP ↑

Annex Wealth Management provides free workshops, open to the public, on key wealth management topics.

Check back soon for new events!Missed one of our events? Watch it HERE.

BACK TO TOP ↑