Axiom | Vol 273

Analysts Change Forecasts As Inflation Appears Less Transitory

Meet The Axiom®’s Guest Editor: Joseph Maller, CPA

I’m Joseph Maller, Director of Tax with Annex Tax Services. The tax services team performs a number of functions, including preparation of client tax returns, tax planning and answering various tax questions. The world we live in continues to become more complex, and so have many tax situations. When I started in this area, “tax season” was the weeks surrounding the April tax submission deadline. Today, tax planning and preparation have become a year-round activity, not just once a year.

BACK TO TOP ↑

Analysts Change Forecasts As Inflation Appears Less Transitory

As we see more signs that inflation is stickier than believed, analysts have updated their dot plots. What’s a dot plot, and what does it have to do with interest rates? Annex Wealth Management’s Dave Spano and Derek Felske discuss.

BACK TO TOP ↑

Poll Recap: What Kind Of Football Fan Are You?

Football season is here, and luckily there are lots of ways to consume it. Are you a diehard NFL fan, fanatic college football buff, member of the high school football cheering section, or Madden addict?

To no surprise, the majority of Axiom readers rank the NFL as their favorite, with college football at a close second.

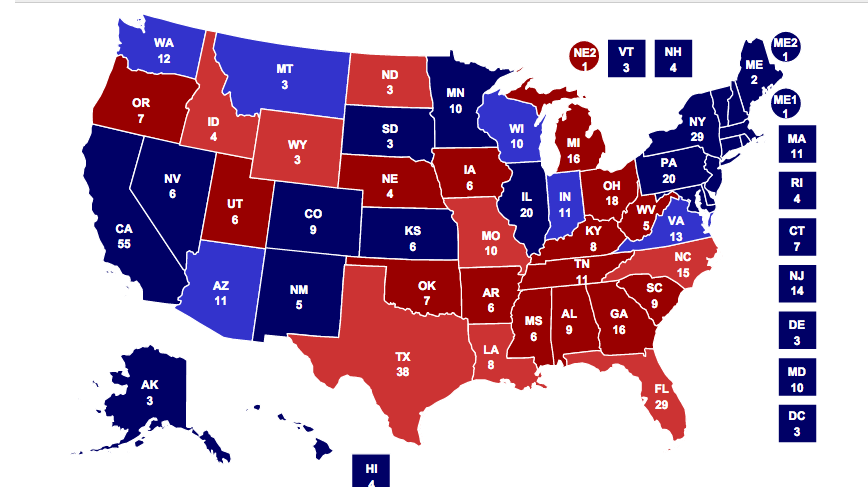

Axiom readers fall right in line with a recent article from sports media website The Comeback: The Electoral map of football: The NFL vs. college football (NFL leaning states are in blue, college football states are in red)

According to the author, Wisconsin is an NFL leaning state.

“Wisconsin (10) – I initially had this in the solid NFL group. I mean, the Packers have had great QB play for 20+ years and a few Super Bowls, and historically it’s one of the NFL’s best teams. That said, UW really represents the soul of the state and is a more popular team in a large part of the state. I’d be very tempted to make Wisconsin red if there were another college team or two in the state, but the Packers plus some Bears fans in the state, makes it blue for now.”

Meanwhile, Florida – from the Gators to the ‘Noles to the ‘Canes – chooses college football slightly over the NFL. While some nearby states have an even greater affinity, Florida’s many successful college programs (including USF and UCF) have most Floridians (slightly) choosing college over the pros.

How about the other options? Well, as much as you love to cheer for your kids and grandkids, only 8% of readers chose high school as their football of choice. As for Madden – it didn’t even make the list. We’ll stay away from discussing who makes the cover of the popular video game in the future.

thecomeback.com (the-electoral-map-of-football-the-nfl-vs-college-football)

BACK TO TOP ↑

Avoid These Estate Planning Mistakes

Innocent blunders can have a big impact on your best estate planning intentions. This week’s MoneyDo is actually a list of MoneyDon’ts: a list of things to avoid as you seek to get your planning on track.

- Not Having an Estate Plan. Consider this: death and taxes are two of the few absolutes in life. Having an estate plan makes sure you effectively plan for both. Effective estate planning also acknowledges who can act on your behalf even in circumstances where you’re still living, but unable to manage your affairs.

- Using Do-It-Yourself Software. Yes, lawyers can be expensive, but the cost is minimal compared to the expense of family fights, litigation, or legal costs your heirs could spend fixing a bad estate plan concocted by a bot.

- Relying on Your Neighbor’s “Legal” Advice. No two estate plans are alike. Your neighbor may have all sorts of information about what they did for estate planning, but their financial situation is likely very different from yours. Avoid any estate planning steps without first discussing your personal situation with an attorney to determine your best course of action.

- Creating Legally Invalid Documents. An estate plan is comprised of multiple documents, each with different requirements for witnesses or notaries. Often, especially with do-it-yourself estate plans, the documents were not properly executed and therefore are not legally valid.

- Naming the Wrong Individual as Power of Attorney, Executor, or Trustee. You’d think that selecting who’s responsible for your financial affairs as you decline and after you die would be one of the biggest reasons to actually create an estate plan. But sometimes, this key detail doesn’t get the consideration it deserves. The individuals you name should be trustworthy, financially responsible, and good communicators who can let all beneficiaries know what is going on throughout the process.

- Failing to do the Follow-Up Work. After you sign your estate plan documents, you’ll still have some work to do. Your attorney likely gave you instructions for updating beneficiary designations or changing how an account is registered. If you don’t complete this, the estate plan will not work as intended.

- Failing to Review and Update Your Estate Plan. Estate plan documents are valid until they’re revoked or superseded by new documents. Your Will from 30 years ago is still legal, so if you have new plans for your assets or new family members, you need to update your estate plan. Estate tax and income tax laws have changed dramatically in the last 20 years, so any plan done before 2005 likely needs to be reviewed and updated to bring it current with the laws in place today.

- Storing Plan Documents in an Inaccessible or Unreliable Location. A safe deposit box works, but only if someone other than you can get access to it. Other location ideas include personal lock boxes or a home safe, but again, make sure someone else has the key or combination. It’s also a good idea to provide copies to family as an additional backup.

- Misunderstanding Your Estate Plan. Often, we’ll work with people who forget or never had a good understanding of how their estate plan works. Ask questions, take notes about your plan. Don’t forget that your attorney is a source of extensive information about the ins and outs of your estate plan.

- Not Communicating Your Estate Plan. Circumstances will eventually require that you’ll likely hand off your day-to-day finances to someone else. Communicating the details of your finances and your estate plan will help ensure the transition is smooth. It’s a gift you can give your power of attorney, executor, or trustee: a simple process which avoids mundane tasks like hunting through decades of files to find out where your bank account is held.

BACK TO TOP ↑

This week’s Ask Annex comes from Arthur, who asks:

“What is market correction vs. bear correction?”

___________________________

We asked Annex Wealth Management’s Blaine Disrud, CFA®:

Both of these terms are related to declines in market prices. The magnitude of the declines is what differentiates a market correction versus a bear market.

Typical rule of thumb for a market correction is a decline of 10% to 20% from recent highs. Once a 20% decline occurs, the market enters what is known as a bear correction, or a bear market. The frequency of these two types of market environments differs, and they’re typically triggered for different reasons, as well.

Market corrections are a more natural phenomenon within equity markets and can be caused by several reasons. Bear markets, on the other hand, are generally caused by economic reasons, such as recessions.

Since 1974, market corrections have, on average, occurred about every other year, while bear markets have only occurred, on average, about every 7 to 10 years. For example, the last bear market we had prior to the COVID Pandemic bear market of 2020 was the Financial Crisis which started in late 2007.

Source for the dates provided:

https://www.schwab.com/resource-center/insights/content/market-correction-what-does-it-mean

Blaine Disrud, CFA®

Research Analyst / Trader

BACK TO TOP ↑

For many business owners, their business is not only their largest asset, but their legacy. When selling a business, it’s important to have a solid plan in place. We’ll discuss the steps that need to be taken to maximize the sale of your business, as well as the kind of team you’ll need to ensure it goes smoothly.

BACK TO TOP ↑

“Axiom is not only a forum to provide education to the clients but it also showcases the depth of knowledge and talent that Annex has available to/for their clients.

The audio segments shared in the Axiom are especially helpful and succinct. I’m a big fan of listening while I’m multi-tasking.”

– Guest Editor: Joseph Maller, CPA | Manager, Annex Tax Services

________________________________________

KNOW THE DIFFERENCE MINUTE:

Online Shoppers: FedEx, UPS Are Raising Rates

KNOW THE DIFFERENCE MINUTE:

Chip Shortage Causing Big Problems For Auto Industry

ANNEX RADIO

Women & Wealth: Preparing For The Unexpected

BACK TO TOP ↑

Annex Wealth Management provides free workshops, open to the public, on key wealth management topics.

Each week, we provide links to register for upcoming events.

BACK TO TOP ↑