August 1, 2021

Quarterly Review & Outlook

By Todd Voit

The Economy

A Pressing Question

The economy and market operate on two different cycles. Keep in mind that for the past 100 years, the market has almost always been a barometer of what’s going on below the surface.

While the market’s role has stayed the same for a century, circumstances affecting the barometer have changed. One structural change affecting the market the past 35 years is steadily declining interest rates, which have adjusted market valuation levels upward. While news commentary might suggest valuation levels are reasonable or that the market should trade at these valuation levels based current interest rates, our thought is: will this remain the case as interest rates trend up?

Data Says…

As far the ‘here and now’, let’s look at the data. Here are recently reported figures[i] (July 29th):

- Gross Domestic Product (GDP) for the 2nd quarter 2021 up 6.5% versus an estimated 8.3%

- Consumer Spending contributed 7.8% to real GDP growth, indicating strong demand.

- Pending Home Sales, reported the same day, surprised to the upside.

- Final read for July’s University of Michigan Consumer Sentiment came in at 81.2, down from June’s 85.5 but better than preliminary 80.8

Data Bottom Line: data is coming in positive, but lower than the prior period. The not-so-good aspect of this: much of the data is not as good as expected by economic forecasters.

We expect future inventory growth to positively spur the economy. The inventory rebuild may not necessarily be the only positive factor looking ahead, but it indicates a good chance for no recession for the whole of 2022 as economic growth decelerates. One factor to watch: too heavy a hand in regulation and taxes could help the deceleration and bring forward the possibility of a recession in 2023 or 2024.

Inflation

Redefining “Transitory”

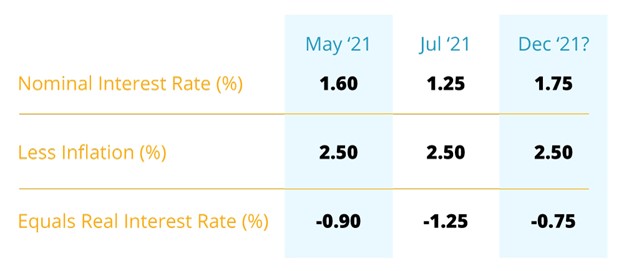

Speaking of inflation, the word “transitory” was intended to mean “a few months” at the start of the year. Now, to quote our Chief Investment Officer Derek Felske, “transitory” appears to have morphed into something longer. The Annex Investment team consults data in Chart A to track how the inflation and interest rates may pan out through the end of the year.

The chart uses general level price indices. A good number of manufacturers face extreme decisions, wondering if they can truly pass higher costs of producing products on. Before our current era, products were sold at one price, based on supply availability and general price indices.

Since then, production for some products has ballooned in cost. Now, it costs so much more to obtain the materials, leaving manufacturers to wonder if they really can pass those costs on to their buyers.

Other manufacturers have a worse dilemma: they struggle to obtain the materials needed to make the product at all, because of supply constraints, and more specifically the container shortage. Add higher taxes and regulation, which will exacerbate the problem for small businesses, and you have a recipe for distress.

We anticipate that supply constraint inflation experienced in the auto and housing industries likely can be resolved; but inflation will settle at a higher level than recently.

1 Chart A: Interest Rate Calculations

How do we get from current nominal interest rates of 1.25% and negative real rates at -1.25% to 1.75% nominal interest rates by the end of the year? Most strategists (i.e., Morgan Stanley, Citi, and Strategas) are still calling for 10 year treasuries to end the year at 1.75 to 2.00%. If we assume nominal interest rates will reach 1.75%, they could be pushed up by inflation expectations or rising real interest rates because of stronger than expected – or possibly less decelerating – economic growth.

The Excess Reserves Problem

The issue with longer-term inflation that has many spooked is something I’ll call potential inflation. Since about ten years ago, excess reserves – the cash held by a bank or other financial institution above the reserve requirement set by the Federal Reserve – exploded to over $1 trillion after the financial crisis. During the crisis, excess reserves were much lower on average.

Why would excess reserves grow to such a large size? Some believed that as the Fed flooded the system with money, loan demand diminished. But according to the banks, it was clear they didn’t want to lend for a variety of reasons – including a new wrinkle instituted during the financial crisis.

In the “old days,” if the Federal Reserve purchased bonds from the U.S. Treasury, it was referred to as “monetizing” the debt and was considered inflationary. Today, since the financial crisis of 2008, the Federal Reserve has a new vehicle to provide liquidity to the banking system and control the money supply: interest rates paid on excess reserves.

2 Chart B: Excess Reserves Have Changed Money Supply

In a quarterly letter to clients written at the time of this lethargic economic growth, it was mentioned that if it is the desire to have economic growth gain some traction, the Fed should stop paying interest on excess reserves, which would likely spur money supply growth.

Today, we have excess reserves (or Reserve Balances) of $4 trillion in the banking system[i]. The crux of the problem is the interest paid on the excess reserves. The Fed may be paying the interest because it has a stake in banks not releasing all excess reserves. If this occurs, we could see a ten-fold increase in the money supply and hence higher long-term inflation.

So, while some aspects of the recent rise in inflation, however measured, are “transitory” in nature, it’s the long-term structural inflation that some strategists, investors and average people are worried about. If it wasn’t for the Fed buying what the Treasury was selling, interest rates would go up to match inflation expectations.

Possible If/Thens

If long rates overpower the Fed’s ability to control them, the yield curve may become more steep and the Fed will be forced to raise rates. Philosophically, the repercussions of higher inflation expectations may also lead to a loss of confidence in Fed, not to mention actual higher inflation makes debt repayment cheaper to the Treasury.

If you’re looking for a possible sign of a Fed Funds rate increase, the canary in the rate coal mine may be interest on reserve balances, which will likely experience a rise before a rise in the Fed Funds rate to keep banks from lending funds out too quickly.

Quarterly Review & Outlook

Equity Market

Fundamentals are solid. S&P earnings estimates have continued to rise since the beginning of the year, putting downward pressure on valuations. At the start of 2021, earnings were expected to be up 38% year-over-year, but soon, analysts realized they were consistently underestimating earnings.

Actual earnings growth rate appears to be closer to 89%, and may even turn out to be 93%, for Q2 of 2021, before earnings season is over. To put this into perspective, the current valuation is, on a common P/E basis, 30. If earnings rise by 100% (round numbers), the denominator of your P/E calculation increases 100% – from 1 to 2, which would cause valuation levels to be cut in half.

3 Chart C: 100% Of E Changes The Equation

Since the market rallied with increased actual and estimated earnings, we contend that the market is still richly priced. Given where earnings are now, in the face of what the data shows as a potentially decelerating economy, a correction in prices is expected.

It may be useful to outline the basic selection criteria in the management of your portfolio, without going into methodology:

Selection Criteria Overall

Fundamental

- Focus on Margins

- Gross, Operating and Cashflow

- Empirical Free Cash Flow and Factors

- Return on Equity, Assets and Invested Capital

- ROE adjusted for Leverage

Valuation

- Discounted Cashflow,

- Multiples of earnings, sales, book value, EBITDA

Trading

- Adjustments to positions, controlling risk

[1] [1] For each quarterly GDP report, there are three versions. The last day of the month following quarter-end (ie. July 31,2021): the “preliminary” figures for the previous quarter (Apr-June, 2021), the middle month of the quarter (August 31st): the “revised” GDP figures for the 2nd quarter, and the end of the third month (September 30, 2021): the “final” figures for 2nd quarter GDP. In the final figures report, 2nd quarter corporate profits are included. Although quite delayed, it is important to see both public and private corporate profits. Because they’re delayed, they don’t have as much impact on the equity market because the corporate profit news regarding publicly traded companies (S&P 500 corporate profits) is well known by that time.

[1] Copy the following web address into your browser for more information: https://fred.stlouisfed.org/series/WRESBAL, https://fred.stlouisfed.org/series/IORB