Todd Voit, PhD

Chief Investment Strategist

________________________________________

Quarterly Recap

The first quarter of 2021 saw the year-end rally continue but not without hitting a soft patch. The first quarter of 2021 saw the long-awaited rotation from growth into value oriented equities. This is, in part, is the reason your equities have probably not outperformed the benchmarks; the stocks I picked up in March 2020 were growth stocks such as Costco, Salesforce, Adobe, Illumina, which contributed to the 21.55% return in 2020 (versus 9.0 to 12% for the benchmarks) are also the same ones that were trading weaker in the fist quarter or 2021 (this doesn’t factor in the lack of risk with the use of the put option)

If I were asked if there is anything we can do about this or if there are changes that are called for and my response would be absolutely not, that’s how companies such as Visa, Apple and Amazon came into client portfolios years ago when the market brought down the prices of growth stock shares. When you think about it, It kind of makes sense, you purchased great growth companies at depressed prices, why not hold onto to them long term.

The S&P500 Growth Index returned 2% while the S&P500 Value Index was up 10.9% year-to-date. The equity markets were pricing in historic economic growth data from two stimulus packages for the coming year and so was the bond market where nominal yields on the 10-year U.S. Treasury bond rose from 1% to 1.7% in a short period of time. This move in interest rates unveiled the rich valuations of growth while value stocks benefited since the root cause of higher interest rates were higher “real” interest rates which rose given the upward revisions to economic growth for the coming year. Another component of this, inflation, starting to sink into investor’s perceptions as well. U.S. domestic bonds, as measured by the Barclays Aggregate Bond Index were down 3.5% for the first quarter. While one force may dominate another, it is illustrative of why portfolios are diversified.

QUARTERLY RECAP

Economic & Market Outlook

According to the Conference Board, inflation is a major concern among consumers and businesses given the lockdown induced shortages and backlogs caused by the pandemic, followed by reopening’s and a rebound in consumer demand. We saw an acceleration in the PCE Price Index from 1.1% in November to 1.6% this past February. There are three catalyst for inflation; demand side (reopening: hospitality, travel) and supply side (short-term bottlenecks, long-term wages) and very accommodative monetary policy. Average hourly wages are not currently a good gauge since average hourly earnings rose over the past year due to lower paying jobs in hospitality, travel, restaurants, etc. disappearing. Now with the reopening’s, expect average hourly earnings to decline as these jobs return from current levels according to Bureau of Labor Statistics (BLS). This will contradict the evidence against inflationary pressures despite the fact that inflationary pressures still exist in every sector of the economy.

Given that the Federal Reserve is committed to keeping short-term interest rates low for the next two years, as the Fed waits for wages to recover, we have stated (on the radio program) the Fed should be careful what they wish for. Larry Summers, former economic advisor to President Obama, recently stated this period has been “the least responsible fiscal macroeconomic policy we’ve had for the last 40 years.”

A more near term scenario could play out as follows:

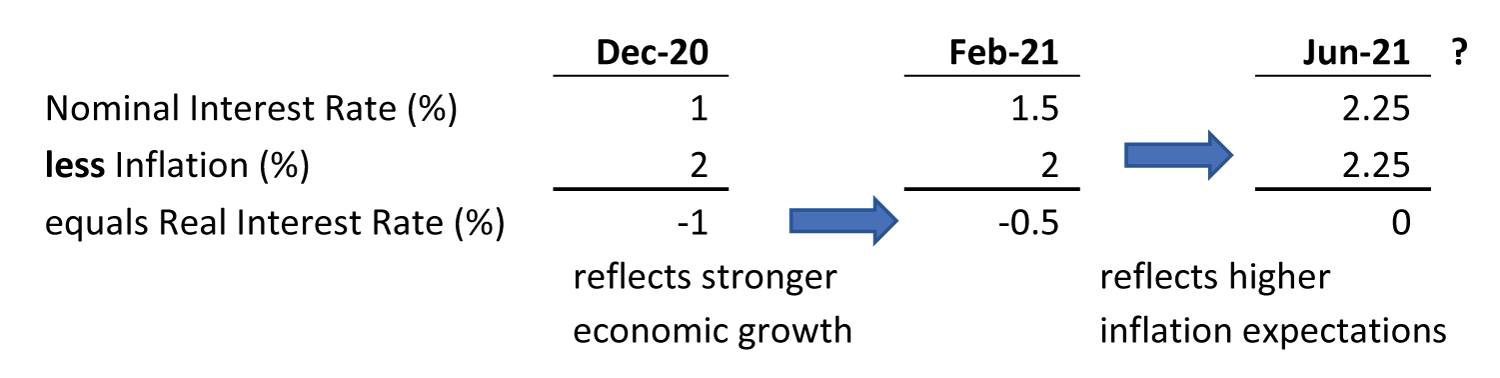

Nominal interest rates are the rates we observe every day. If you subtract inflation, you’re left with real interest rates. It is real interest rates that have initially increased on expectations for strong economic growth ahead. If inflation expectations rise, or more significantly, the Federal Reserve adjusts plans for raising interest rates sooner rather than later, it will likely spell trouble for the bond market.

QUARTERLY RECAP

Equity Market Uptrend Under Pressure

In the current market environment, the market’s direction can change on a dime. In late February, early March, the Nasdaq and S&P 500 index saw losses on rising volume and gains on low volume, a sign that there are more selling than buying pressures.

According to FactSet, the estimated earnings growth rate for the S&P 500 is 23.8% (it was 15.8% on December 31st). Not the biggest fan of forward PEs but the forward 12-month P/E ratio for the S&P 500 is 21.9 which is higher than both the 5-year average (17.8) and 10-year average (15.9), and according to Goldman Sachs, in the 99th percentile of valuation so clearly the great expectations of the market have been discounted. Can the economy not only live up to expectations, can it exceed it?

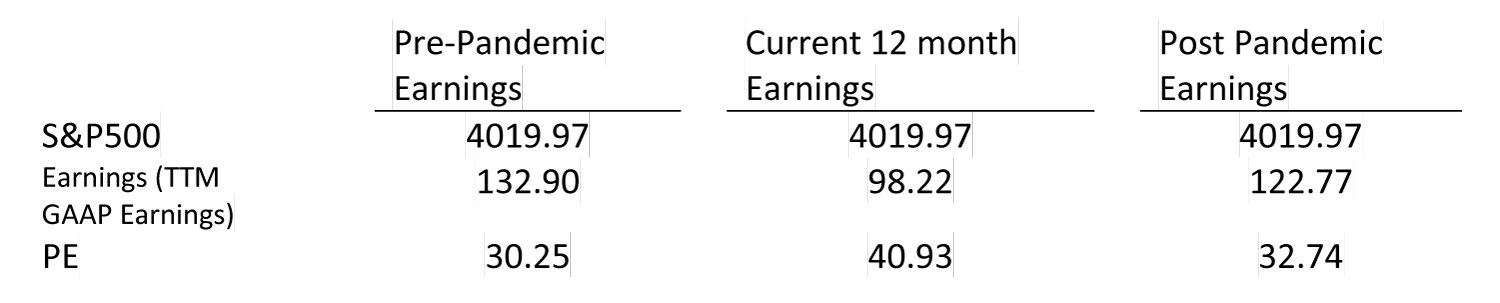

The market is stretched in terms of valuation. On current trailing 12 month GAAP earnings:

Given current 12 TTM earnings include depressed earnings, we can use pre-pandemic or post-pandemic earnings and still have the market trading at historically high valuation levels as measured by price-to-earnings ratios (PE). The problem is, like 1998, the market can stay overvalued for a while. The market is heading into a seasonally weak period and both the Stock Trader’s Almanac and the research firm Strategas believe where the seasonality in the market will revert back to ‘normal’ after last year’s aberration. If this is the case, and interest rates (10-year Treasury) remain between 1.7% to 2.0% and employment, manufacturing data come in less than expected or inflation expectations rise significatly, we may see a correction; however, there is quite a bit of cash to come back into the market. Like 1998, any further rally in stocks may just mean a longer, deeper bear market later as earnings have to catch up as the market corrects to bring valuations down to reasonable valuation levels (PE ratios around 20). Further out, we could assume no exorbitant inflation, a deceleration in GDP growth (not hard to predict after 9% growth expected by the Fed model) and a cyclical, natural recession in the 2023, 2024 period.

Consequently, we will more likely have a longer duration (2-year) bear market which makes the case for active portfolio management.

QUARTERLY RECAP

International

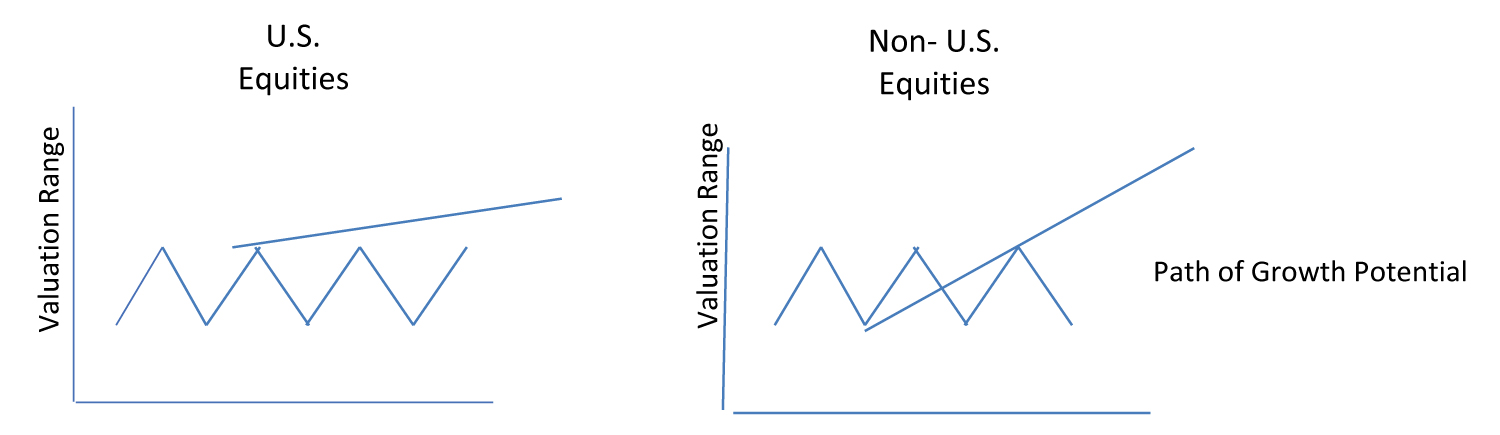

It has been believed that in a relative sense, the Japanese and European economies have a lower base to improve upon as the COVID vaccines are rolled out, making the case for a secular bear market in the dollar. A simple visual might explain why this is the case. With valuation levels higher in the U.S. (the trailing 12 month PE is above its long-term average), the potential return is lower as indicated by the slope of the line in the chart on the left. Starting from below average valuation levels, the potential growth in terms of return, are higher for non-U.S. equities.

Annex’s investment strategies incorporate these thoughts when structuring diversified portfolios with a greater emphasis on international equities. In the meantime, there are other factors we continue to monitor:

- The Fed remains on our side, Powell and Yellen want the economy to run hot.

- Ample liquidity remains with stimulus bill expected to add more.

- From a psychological perspective, sentiment is still positive (look no further than relative cash flows into domestic equities versus fixed income in last decade). The great rotation may be just beginning.

- Risks to monitor:

- There are signs of froth. “SPACulation” (Special Purpose Acquisition Companies, a new form of IPO), a hot IPO calendar, the GameStop fiasco, and exuberance over Bitcoin to name a few bring speculative elements into the market.

- Valuations are stretched unless you believe analyst estimates are too low which is entirely possible.

We would be remiss if we didn’t mention that risks certainly remain:

- Possibility of higher corporate taxes to fund infrastructure which could reduce current earnings estimates as much as 10%.

- An inflation scare which could compress P/E multiples.

- The possibility the fed is forced to tighten earlier than people expect.

We have rallied so much over the past 11 months. On average we see a 10% correction every 11 months, so it could begin at any time.

QUARTERLY RECAP

Moral of the story:

Remain balanced. Add risk opportunistically. Focus on a generation of solid risk adjusted returns.