MoneyDo: If You’re Looking To Find A More Tax-Friendly State, Look At These Key Factors…

With the new federal tax law in effect, there has been a lot of talk about the change in the SALT (state and local tax) deduction, a deduction we receive for state income taxes and property taxes paid.

SALT deductions continue to be limited to $10,000 per return in 2020, and are slated to remain capped through 2025, which means many people may not be getting the same tax benefit for state income taxes paid. Moving to a no- or low- income tax state during retirement may be more appealing.

Consider Your Destination

Nine states do not have an income tax:

· Alaska

· Florida

· Nevada

· South Dakota

· Texas

· Washington

· Wyoming

Some states, such a Tennessee and New Hampshire, tax only dividends and income from investments, such as Tennessee and New Hampshire.

Consider What It Takes To Leave

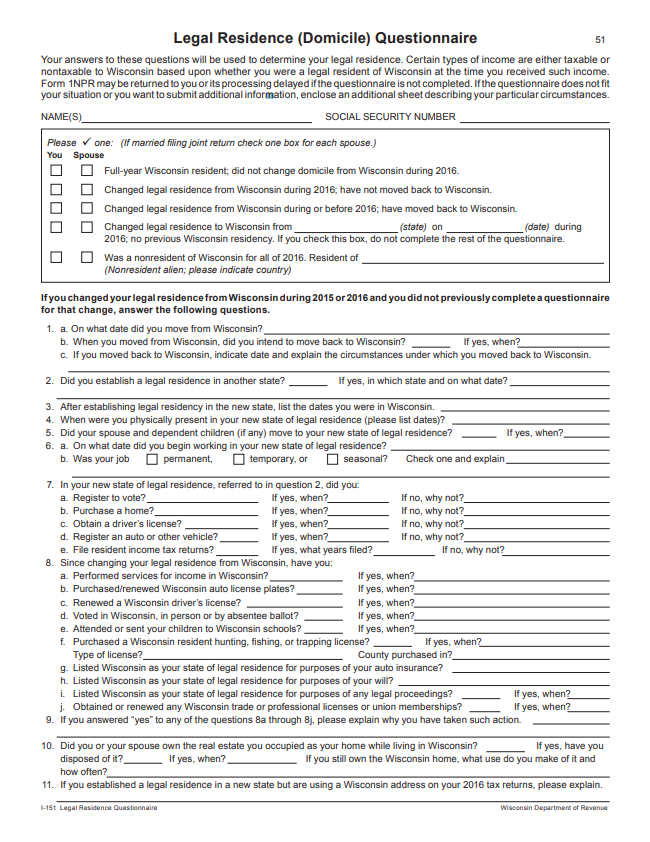

Before you make the switch to leave your home state, be aware of what the state uses to determine your legal residence for income tax purposes. Below is the Wisconsin’s Legal Residence Questionnaire, which asks questions such as did you change your driver’s licenses, where you vote, where your car is insured, and what your future intents are.

Wisconsin typically requests the form with your tax return in the year you change your residency.

Consider What It Takes To Establish Residency

Depending on what state you move to they may have their own requirement on what you need file/do to establish residency. For instance, in Florida you are able to file a Declaration of Domicile, affirmatively establishing your intent to be a Florida domiciliary going forward. Please see your advisor for a comprehensive list of action items for establishing domicile in your target state.

Consider If You’ll Be Paying Partial-Year State Taxes

If you’re deducting expenses on your federal tax return at tax time, keep in mind that you may have to file two separate state tax returns when you move out of state. If you earned income in two different states during the fiscal year — unless you’re moving to or from a state that does not collect individual income taxes, you’ll need to file a return in each state to cover the time you lived there.

Consider Changes To Insurance

If you’re changing jobs, consider your individual or new employer-sponsored insurance options, like life, health and disability insurance. Ask your private insurance provider about coverage for your cars, any items you have in storage and your residence to make sure you’re covered during your move.

Talk with your financial advisor about any insurance policies you have to see if they still apply to your change in circumstances. Sometimes, more or less insurance is necessary when you move someplace new.