Whether you’ve just begun building your financial plan or are recalibrating your existing plan, one healthy first step is calculating your net worth. Your net worth will give you a clear picture of your financial health, and help you quickly determine whether you’re increasing your wealth or getting yourself deeper into debt.

The calculation may seem like simple math, but many find that answering simple questions can dredge up emotions and pain points that mar their financial outlook. What your house should be valued at doesn’t matter in this calculation; nor does your New Year’s resolution to get serious about your student loan.

In addition, net worth doesn’t really care about the kind of car you drive or your sense of style. It’s just an honest financial mirror that will let you see your true self – critical when it comes to making decisions about retirement and your financial future.

How To Calculate Net Worth

Start writing down the things you own. Furniture, jewelry, properties you own, and include your 401(k), IRAs and savings accounts. For simplicity’s sake, don’t worry about depreciating the items, just get them written down, along with their current value.

Remember – be honest, and if you can, be conservative in your valuations. The emotional value of that diamond ring likely will exceed its actual value.

For most people, creating a list of liabilities isn’t as hard as making a list of assets. That’s because debtors are always interested in reminding you of what you owe. Get those statements out and record your list of liabilities, including mortgage(s), loans, credit cards and student loans.

Finally, total both columns up, and subtract your liabilities from your assets.

An Example: Bernie Milwaukee

Bernie Milwaukee, a 42 year-old executive who lives in Milwaukee, makes $100,000 a year.

He paid $528,000 for his lakefront condo a few years back, and the lakefront is booming these days: it’s currently valued at $575,000. His mortgage on the condo has a remaining balance of $435,000.

Bernie drives his hybrid Ford Fusion he bought for $52,000, and he still owes 44,000 on it. He’s run up $18,000 in credit cards, but he typically pays the bills off as soon as he gets them. Bernie is paying off his Marquette student loans, but still has $90,000 left there, but he’s going to really get going on knocking those down over the next five years.

Bernie has already got almost $78,000 in his 401(k) account, and also has an IRA of near $18,000.

Assets:

- IRA + 401(k): $58,000 + $18,000 = $76,000

- Condo: $575,000 – $435,000 = $140,000

- Car, Student Loan, and Credit Card: -$44,000 + -$18,000 + $90,000 = -$152,000

Bernie’s Net Worth: $76,000+$140,000-$152,000=$64,000

Is That Good Or Bad?

If you’re like many people, you might be able to calculate Bernie’s or your net worth relatively quickly. But what does it mean?

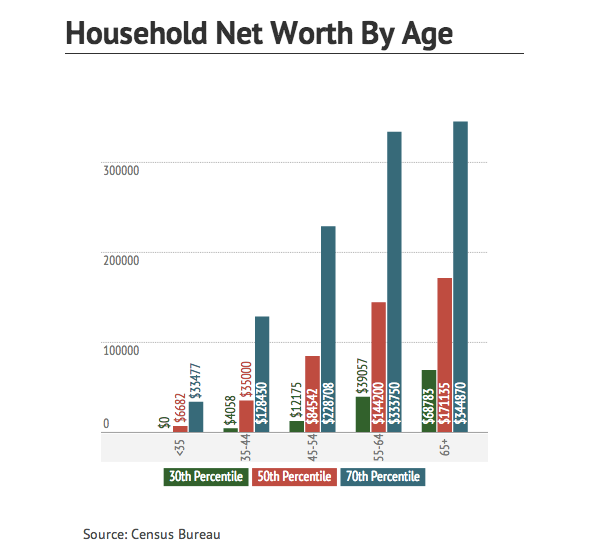

According to the Census Bureau, Bernie’s in an OK spot – for now. His net worth has him between the 50th and 70th percentile for his age group. Then again, in three years, he’ll be graduating from his age group where the net worth expectations practically double.

Devising Or Recalibrating

Whether your calculation exhilarated or depressed you, there’s a good chance that performing a net worth exercise has you wondering if you should consult a financial professional for creating or recalibrating your financial plan.

Remember, there’s a significant difference between financial advisors. Make sure to rely on someone you can trust, someone who will give you a real plan, not a list of things to buy.