1. Interest Rates Will Remain High, We Are On Watch For A Credit Event 2. How Did You Finance Your College Education? 3. The Difference Maker Of The Game. 4. Considering A Power Of Attorney For Adult College Students. 5. 401(k) Loans | Investing In Fan Favorite Companies | S&P 500. 6. “Education Is The One Thing That No One Can Take Away From You.” 7. Financial Planning For Gen Z.

Annex Wealth Management’s Dave Spano and Derek Felske discuss the Jackson Hole Fed meeting, interest rates, and the possibility of a credit event.

How Did You Finance Your College Education?

As anticipation of college football builds with kickoff just around the corner, so is the repayment of student loans. The U.S. Department of Education’s COVID-19 relief for student loan forbearance program is ending soon with interest resuming on September 1, 2023, and payments activating with a due date beginning in October 2023.

We want to know: How did you finance (or are currently financing) your college education? You can choose more than one option if needed:

BACK TO TOP ↑

The Difference Maker Of The Game

Brewers vs. Twins | August 23, 2023

Click to listen!

Check out the full archive HERE.

BACK TO TOP ↑

Consider A Power Of Attorney For Adult College Students

Fall is making its presence known first thing in the morning air. Extra-long twin bedding sets and shower caddies are the first thing you see when walking into the store. Students are getting ready to move to college and packing lists are steadily growing. However, have you considered having a conversation with your college student to add executing powers of attorney to their list?

For college students, powers of attorney can be a practical tool to ensure that someone can manage their financial affairs while they are away at school or make health care decisions in the case of sickness or another medical emergency. There are two kinds of powers of attorney, a Durable Power of Attorney (DPOA) names an agent to act on behalf of the creator of the document, known as the principal, with regard to the principal’s financial matters. Similarly, a Health Care Power of Attorney (HPOA) names an agent to make health care decisions a principal in the event they are unable to do so. While it’s tough to imagine your children growing up and leaving the nest, it’s important to remember that your students can name any trust individual they wish to act as their agent under a DPOA or HPOA. It is not a requirement for parents, or even family members, to be named.

Having a DPOA and HPOA in place is important because once a person becomes a legal adult, parents lose any authority to make decisions on their behalf or receive their health care information. It is important to note that a parent cannot set up a power of attorney over a legal adult child. The student will need to initiate the process of establishing their powers of attorney by setting up a meeting with an estate planning attorney.

This Week’s MoneyDo: Share this information with your student and encourage them to make an appointment with an estate planning attorney so they are prepared in the case of an unplanned event.

Scope of DPOA

-

-

-

- Financial Matters: a named agent can assist a student with paying bills, managing bank accounts, signing financial documents, or entering into contracts in the event the student is not able to do so.

- Academic and Administrative Matters: An agent can also assist with completing academic or administrative matters on a student’s behalf, including course registration, accessing academic records, or communicating with institution officials.

- Leases and Other Contracts: If your student is living off campus and has a lease agreement, an agent acting under a DPOA can sign or manage rental-related documents for your student, or any other contract they may need to enter into.

-

-

Scope of HPOA:

-

-

-

- A HPOA allows a trusted individual identified by the student (agent) to make medical decisions on their behalf if they become incapacitated or unable to make decisions for themselves.

- This is especially critical if the student is attending school away from home and needs someone to communicate with healthcare providers in an emergency.

-

-

Consider sharing this MoneyDo with your student so they can better understand how powers of attorney can provide peace of mind and ensure that their financial and health care needs can be provided for in accord with their wishes. Consulting with an estate planning attorney can provide your student guidance and help them draft a document that meets their specific needs and ensures their interests are safeguarded. In the end, both you and your student will likely be better positioned to handle an unexpected event.

BACK TO TOP ↑

Annex Wealth Management’s Sarah Kyle and Matthew Morzy, CFP® answer several Ask Annex questions.

Do you have a question for Annex Wealth Management? Drop it here.

BACK TO TOP ↑

As schools are returning back in session for a new year of learning, be sure to remember that the education you’ve earned can enhance your skills and provide a story about your past. It is the one valued treasure that cannot be taken away from you. You invested in you.

BACK TO TOP ↑

Did you know many Gen Z’ers (currently 10-25 years old) find it daunting to think about saving, investing and planning for their retirement? Many Gen Z’ers are looking for that instant gratification that can come from spending money now and are not focusing on the bigger picture of their future.

Please click below to join Financial Planning Specialist, Jenny Jesse, CFP, as she discusses five things her fellow Gen Z’ers can do to avoid getting caught up in current financial fads and ways you can educate the Gen Z’ers in your life to get their financial planning habits in order now. In addition, be sure to connect with a Wealth Manager at Annex, to lead by example for the Gen Z’ers in your life.

Refresh Your Financial Future. Calibrate Your Financial Plan.

BACK TO TOP ↑

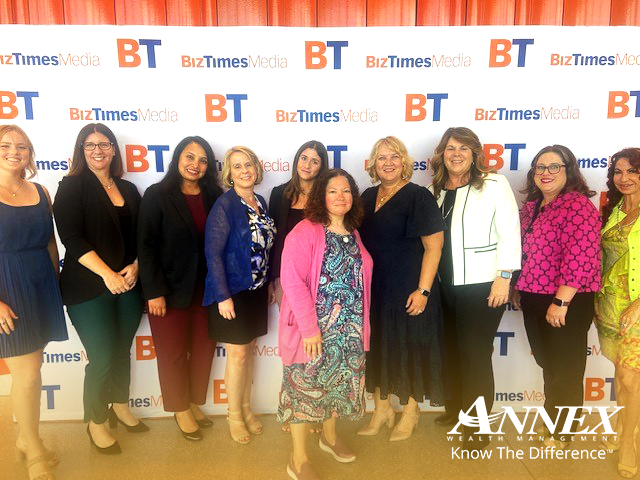

Annex Wealth Management had the privilege of partnering with BizTimes Media for their Women in Business Symposium, hosted this past week at the Brookfield Conference Center. The theme for this year was “What Do I Need Right Now?”

This special event provided opportunities for women to network, spark fruitful conversations, and learn important skills to encourage growth in their fields.

We were fortunate to have ten powerful Annex women attend the sold-out symposium. We look forward to attending more events like this in the future!

BACK TO TOP ↑

Annex Wealth Management provides free workshops, open to the public, on key wealth management topics.

Join us in September for our upcoming event at our Elm Grove office: Are Annuities Worth It?

Annuities are one of civilization’s oldest financial instruments. But what are they, and do their benefits outweigh their pitfalls? Annex Financial Planners discuss if and when an annuity might make sense – and potential dangers of annuity ownership.

BROWSE EVENTS →

Start the week off with insight and perspective from members of the Annex Wealth Management Investment Committee.

This Week’s Focus: Solid portfolio construction manages volatility while the problems with China’s economy have the potential to spread wider. Opportunities exist via active management while threats include the effect of quantitative tightening.